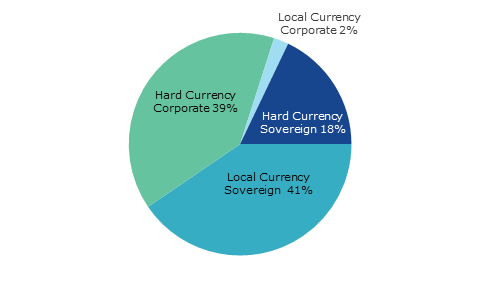

The Emerging Markets bond universe has evolved. Representing 42% of the investable universe, local currency sovereign bonds have 1.2 trillion USD equivalent outstanding in 20 currencies, and is 90% investment grade rated. Corporate bonds total USD 1.1 trillion market value, 37% of the universe, and 65% of the market is investment grade. Local currency debt and corporate debt each represent unique risk and reward characteristics. Attractive yields and lower default probabilities in local currency sovereign bonds have been a secondary driver of returns behind currency movements, which have had an adverse effect in 2014. Corporate bonds generally offer higher spread than hard currency sovereign debt in exchange for added idiosyncratic risks and generally lower trading liquidity.

Source: FactSet

Data as of 30 Sep 2014

About the Author:

Francis G. Rodilosso, CFA (MBA ─ with distinction, Finance, The Wharton School, University of Pennsylvania; BA, History, Princeton University, 1990). Mr. Rodilosso serves as Senior Investment Officer and Portfolio Manager for various fixed-income exchange-traded funds (ETFs). Mr. Rodilosso previously held positions at the Seaport Group (Managing Director of Global Emerging Markets), Greylock Capital, Soundbrook Capital, Credit Lyonnais and HSBC.

The article above is an opinion of the author and does not necessarily reflect the opinion of MV Index Solutions or its affiliates.