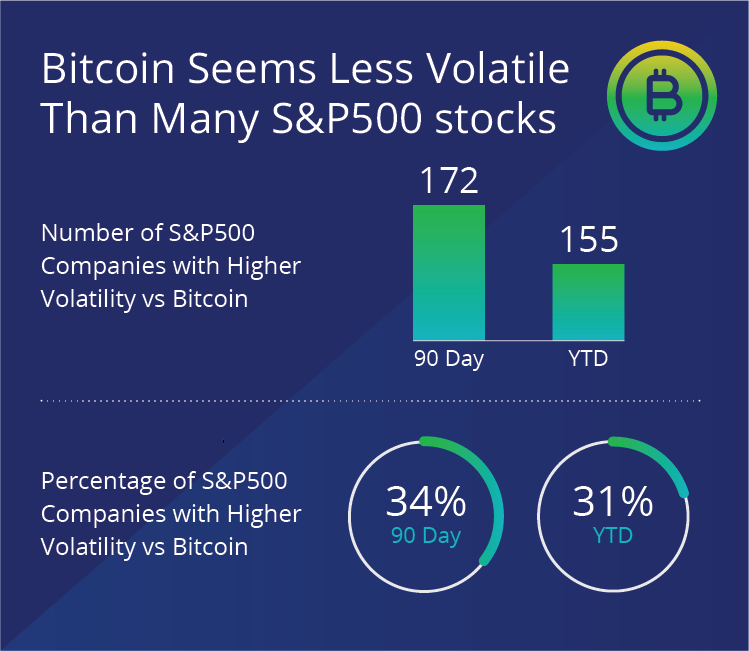

Historically, bitcoin has been discussed in the news and among investors as a nascent and volatile asset outside of the traditional stock and capital markets. Much of the volatility over the past few years can be attributed to sensitivity to small total market size, regulatory hurdles and generally limited penetration in mainstream stock and capital markets. While bitcoin continues to be a volatile asset, it may surprise researchers and investors as to what other major assets have been more volatile than bitcoin.

While there are no U.S. bitcoin exchange traded funds (ETFs) available today, we believe such products may show similar volatility characteristics—based on the comparison above—as many stocks in well-known indices and ETFs, such as the S&P 500 and related products.

Get the latest news & insights from MarketVector

Get the newsletterRelated:

About the Author:

Gabor Gurbacs is the Director of Digital Asset Strategy, and former member of the ETF product management team, at VanEck. Mr. Gurbacs has extensive digital asset trading and market structure experience on global digital asset trading platforms and he is well known in the digital asset community. Prior to joining VanEck, Mr. Gurbacs was a George Soros Scholar, Edgar Bronfman Fellow, serial entrepreneur, and holder of several new economy finance research positions at the Massachusetts Institute of Technology (MIT), Harvard, and Williams College. Mr. Gurbacs earned a BA from Williams College, triple majoring in Mathematics, German, and Sociology.

The article above is an opinion of the author and does not necessarily reflect the opinion of MV Index Solutions or its affiliates.DISCLOSURES

1 Standard deviation is a statistic that measures the dispersion of a dataset relative to its mean and is calculated as the square root of the variance.

This is not an offer to buy or sell, or a solicitation of any offer to buy or sell any of the securities/financial instruments mentioned herein. The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.All indices are unmanaged and include the reinvestment of all dividends but do not reflect the payment of transactions costs, advisory fees or expenses that are typically associated with managed accounts or investment funds. Indices were selected for illustrative purposes only and are not securities in which investments can be made.

The S&P® 500 Index: a float-adjusted, market-cap-weighted index of 500 leading U.S. companies from across all market sectors.

All S&P indices listed are products of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Van Eck Associates Corporation. Copyright © 2018 S&P Dow Jones Indices LLC, a division of S&P Global, Inc., and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices please visit www.spdji.com. S&P® is a registered trademark of S&P Global and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC. Neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors make any representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors shall have any liability for any errors, omissions, or interruptions of any index or the data included therein.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.