In 2001, Nvidia ($NVDA) joined the S&P 500 Index. At the time, General Electric ($GE) was the largest company in the index. Fast forward two decades to November 14, 2024, and Nvidia has claimed the top spot in the S&P 500 Index, while General Electric has fallen to 44th. Nvidia’s meteoric rise, fueled this year by the AI boom, showcases the unpredictable nature of markets.

Year-to-date (as of November 14, 2024), Nvidia is up nearly 200%, dominating the S&P 500’s performance. However, as we approach its next earnings announcement on November 20, 2024, the question remains: Can Nvidia continue to outperform? More importantly, how can investors navigate the inherent unpredictability of highly volatile assets like Nvidia or Bitcoin while positioning themselves for long-term outcomes?

Who Will be Number One?

Nvidia’s climb to the top of the S&P 500 seemed improbable in 2001 when GE reigned supreme. Similarly, few could have predicted GE’s significant decline or Nvidia’s rise to prominence over the next two decades. The same unpredictability applies to digital assets today: investors focused on Bitcoin might overlook thousands of other digital asset securities that could emerge as leaders. The lesson? Today’s top performer may not be tomorrow’s top performer. Investing in a single asset is exciting but inherently risky.

Can Information Predict Price?

Even with detailed information, predicting price movements is incredibly challenging. Nvidia’s Q2 2024 earnings, for example, beat both expectations and guidance, yet its stock price fell nearly 8% the next day after the announcement, erasing over USD 200 billion in value. Markets are forward-looking, and price movements reflect not just new information but also new expectations across all market participants. Positive surprises in information doesn’t guarantee a positive price reaction—and this unpredictability underscores the difficulty of relying on any single information alone to time the market.

Volatility vs Stability

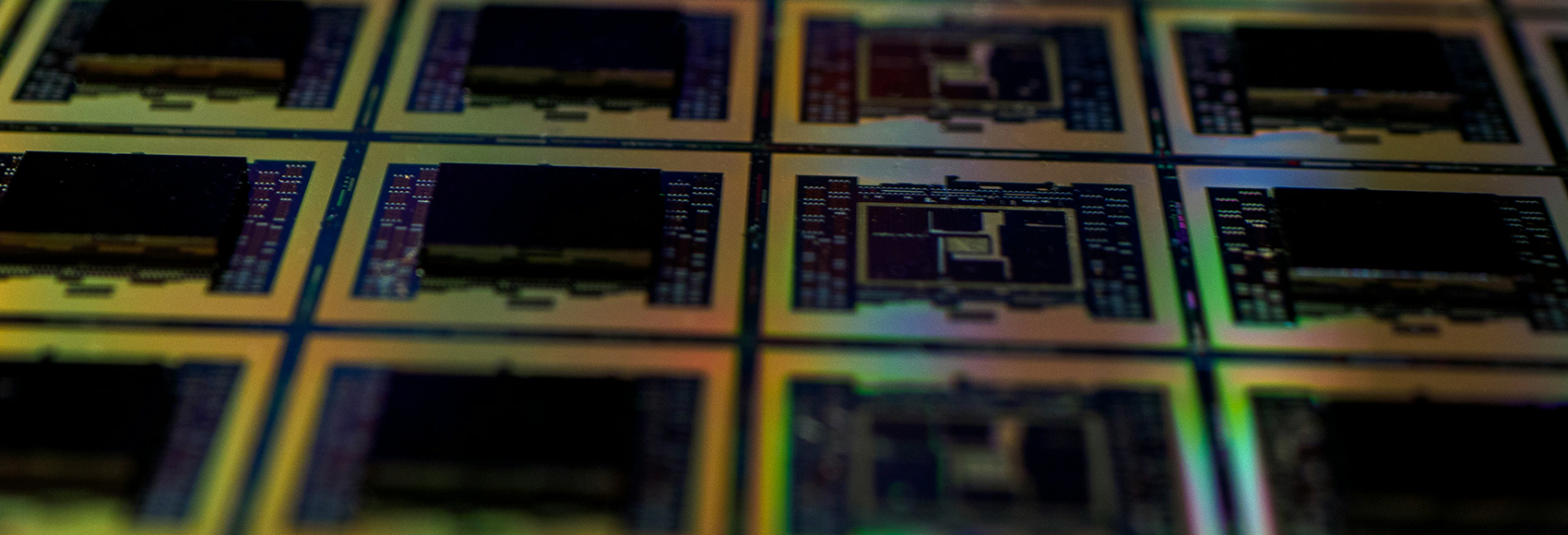

Investing in individual stocks like Nvidia can be exhilarating but it comes with significant volatility. With an annualized volatility of 50% over the 365 days ending November 14, 2024, Nvidia is as volatile as Bitcoin, meaning Nvidia and Bitcoin price (BBR) can swing up or down by 50% over any given one year period. For investors who want a steadier return for stocks like Nvidia, consider the companies in the MarketVectorTM US Listed Fabless Semiconductor Index (MVSMHX) which tracks the performance of the top US-listed companies that specialize in the semiconductor industry and operate as fabless semiconductor companies. Similarly for Bitcoin, consider the Coinbase 50 Index (COIN50), which tracks the performance of the 50 largest and most liquid digital assets by market capitalization. A diversified basket of stocks or digital assets offers a steadier approach, does not rely on consistently guessing which asset will outperform, and uses the market to determine the top rankings.

Exhibit: Single Stock vs Diversified Index (NVDA vs MVSMHX, BBR vs COIN50)

Source: MarketVector. Data as of November 14, 2024.

As Nvidia prepares to release its earnings on Wednesday, November 20, investors should remember that markets are unpredictable in both the short and long term. Rather than chasing the excitement of any single asset, a diversified strategy—linked to broad stock indexes like MVSMHX or digital asset indexes like the COIN50—offers a steadier path to long-term outcomes. So, after the market closes on Wednesday, sit back and relax. You can’t trade Nvidia until Thursday anyway.

For more information on our family of indexes, visit www.marketvector.com.

Get the latest news & insights from MarketVector

Get the newsletterRelated: