Last week, China surprised the markets with new stimulus packages aimed at reviving the slowing economy. Markets responded in kind, with Chinese stocks surging. China's new stimulus measures have jolted the stock markets awake, and investors are keen to discover how the 'Hidden Dragon' is poised for a powerful resurgence.

Crouching Tiger: China Underperforming Other Markets

As the worlds second largest economy, ranked by GDP, China has averaged over 9% GDP growth per year since it opened up and reformed its economy in 1978. Yet since the pandemic, China has underperformed most major markets, with the CSI 300 (a broad free-float weighted index of stocks listed on Chinese exchanges) down over 40% from its peak in February 2021 to lows in September 2024.

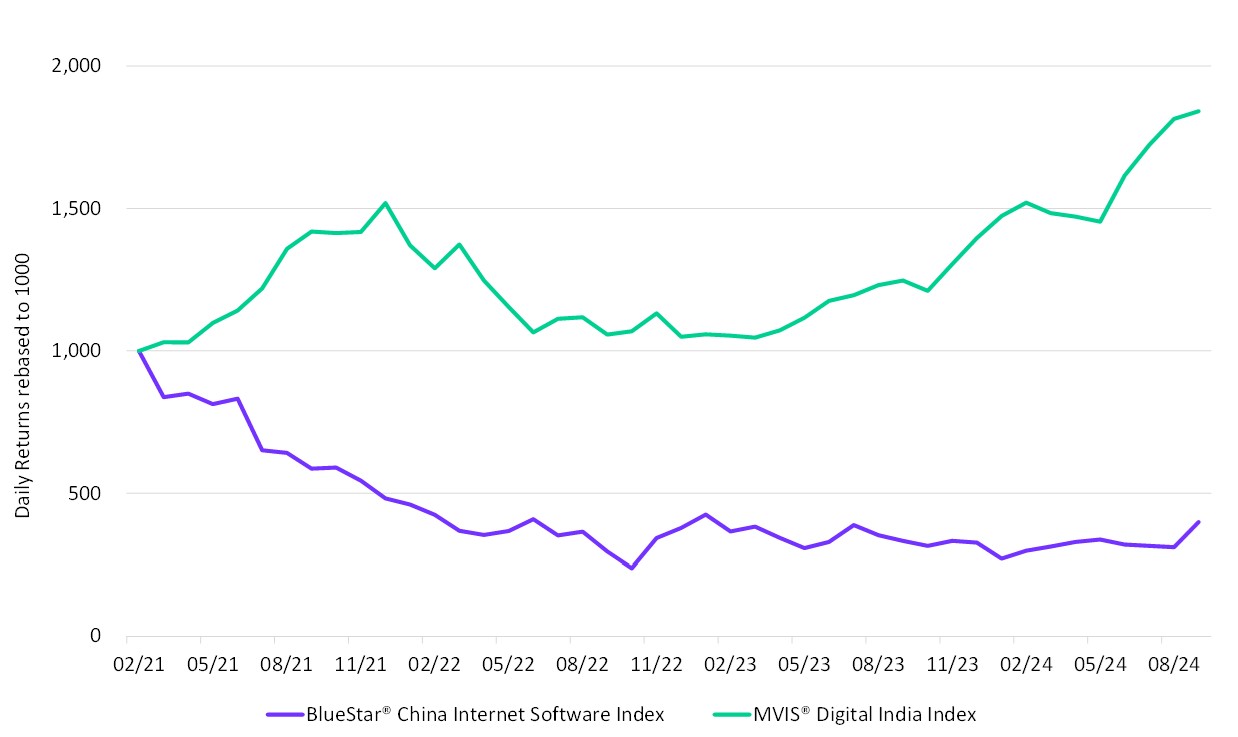

MarketVector’s BlueStar® China Internet Software Index (BCHNQ), an index focused on Chinese internet software companies, underperformed the MVIS® Digital India Index (MVDIND), an index focused on Indian tech, telecom and internet companies, by -150%, from February 28, 2024 to August 31, 2024.

Many investors took this as a sign of the end of China’s dominance, pulling money out of exchange-traded funds focused on China. With India seen as a major beneficiary of equity investors rotating out of China, India dethroned China by weight as the largest market across investable stock market benchmarks when adjusted by free-float.

Exhibit 1: China Underperforming India from 2/28/2021 to 8/31/2024

Source: MarketVector. Data as of August 31, 2024.

Hidden Dragon: Can China stimulate the markets?

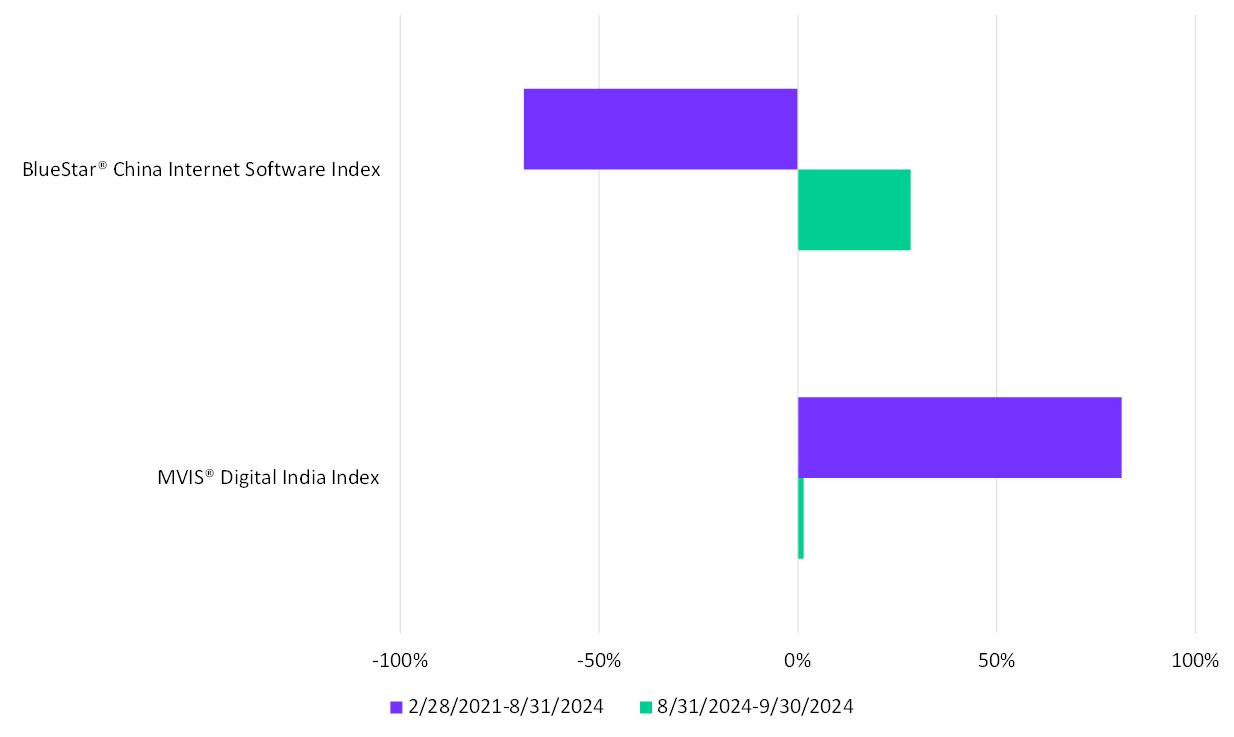

Last week, China surprised the markets with a series of announcements related to major monetary and fiscal stimulus packages designed to put the country back on track to 5% growth rates. In addition, China announced plans to “step up state investment in the country’s rapidly expanding exchange-traded fund industry and growth the number of ETFs investing in the tech sector”. As a result, the BlueStar® China Internet Software Index (BCHNQ) saw a dramatic 28% rise in performance over the month of September.

Exhibit 2: China Performance Turnaround - China vs India

Source: MarketVector. Data as of September 30, 2024.

What next for China Stocks?

With China’s economy showing signs of renewed vigor, investors should keep a close eye on developments in China’s policy and economic landscape. The success of these stimulus measures could reignite interest and investment in Chinese markets and companies with revenues tied closely to China’s economy.

The global financial community will be watching closely to see if China can maintain this newfound momentum and continue to awaken the 'Hidden Dragon' within its markets.

For more information on our family of indexes, visit www.marketvector.com.

Joy Yang is the Head of Product Management and Marketing at MarketVector. She is responsible for managing MarketVector products and services to accelerate innovation in financial index design and adoption. Joy brings more than 25 years of investment experience to MarketVector, having led teams delivering index and quantitative-active investment solutions at Arabesque Asset Management, Dimensional Fund Advisors, Vanguard, Aberdeen Standard Investments, AXA Rosenberg, and Blackrock. She has an MBA from the University of Chicago Booth School of Business and a Bachelor of Science in Electrical Engineering from Cooper Union’s Albert Nerken School of Engineering.

For informational and advertising purposes only. The views and opinions expressed are those of the authors but not necessarily those of MarketVector Indexes GmbH. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts, and other forward-looking statements, that do not reflect actual results. It is not possible to invest directly in an index. Exposure to an asset class represented by an index is available through investable instruments based on that index. MarketVector Indexes GmbH does not sponsor, endorse, sell, promote, or manage any investment fund or other investment vehicle that is offered by third parties and that seeks to provide an investment return based on the performance of any index. The inclusion of a security within an index is not a recommendation by MarketVector Indexes GmbH to buy, sell, or hold such security, nor is it considered to be investment advice.

Get the latest news & insights from MarketVector

Get the newsletterRelated: