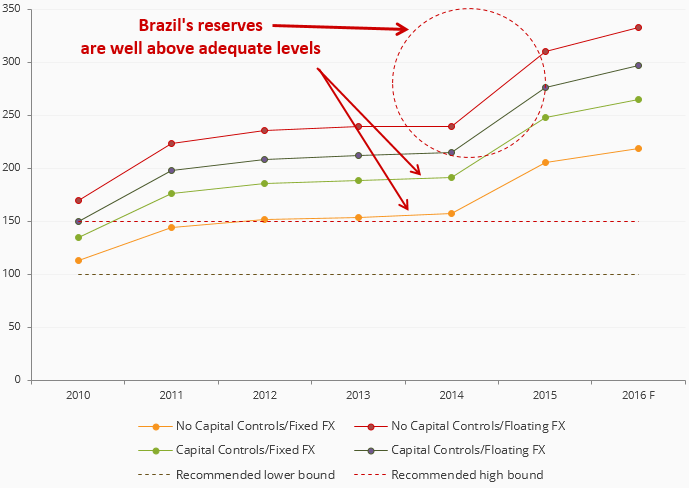

Brazil is a net sovereign creditor in U.S. dollars: It has larger U.S. dollar reserves (USD 350bn) than external debt (at USD 150bn) which can be positive for external debt in two ways. First, it describes literal solvency – the country is able to pay its external obligations. Second, a country with an active debt management policy will purchase bonds, raising their price (all things being equal, of course) and reducing the country’s debt.

Net creditor status, though, does not mean that a country has no problems. Brazil, for example, is increasing its local currency debt significantly. However, if a country’s central bank has a floating exchange rate, it will tend to leave reserves alone, and not defend a particular exchange rate. This increase in local debt, then, becomes largely irrelevant for external obligations, because reserves stay the same, as does external debt.

Brazil – International Reserves as % of Recommended (Adequate) Reserves

Source: Van Eck Research, Bloomberg, IMF, WB

Get the latest news & insights from MarketVector

Get the newsletterRelated:

About the Author:

Eric Fine (MPA, International Trade/Finance, Harvard University and BA, Public Policy, Duke University) has been with VanEck for seven years as Portfolio Manager for the firm’s Unconstrained Emerging Markets Bond Strategy. Mr. Fine worked at Morgan Stanley for 14 years, including 10 years in its Global Emerging Markets Economics and Strategy research group and four as the head of the company’s Emerging Markets focused proprietary trading group, winning numerous awards and outperforming indices with his model portfolios. Prior to his time at Morgan Stanley, he started and led a telecommunications company in Russia that built the country’s first securities clearing system.

The article above is an opinion of the author and does not necessarily reflect the opinion of MV Index Solutions or its affiliates.