We view gold equities at present as generally undervalued, trading at low multiples both historically for the industry and relative to gold. We believe this valuation gap provides an opportunity for gold equities to outperform gold even in a sideways gold price environment, especially if that price action develops around the USD 2,000 an-ounce level.

Industry cost inflation has mostly subsided, and operating costs appear to be contained, with all-in-sustaining costs on average at around USD 1,300 per ounce. While we reiterate our outlook for higher gold prices in 2024, we want to highlight that at current spot gold prices of around USD 2,040 per ounce, the gold miners, as a group, should be able to enjoy margin expansion and enhanced free cash flow generation this year.

We expect gold companies to have the ability to produce solid operating and financial results that can withstand the volatility of the gold price and demonstrate that they can sustainably operate profitable businesses throughout the cycles. We believe that consistently proving this resilience to the markets should lead to increased incorporation of gold equities as an asset class in the broader investment universe and lead to a rerating of the gold mining sector.

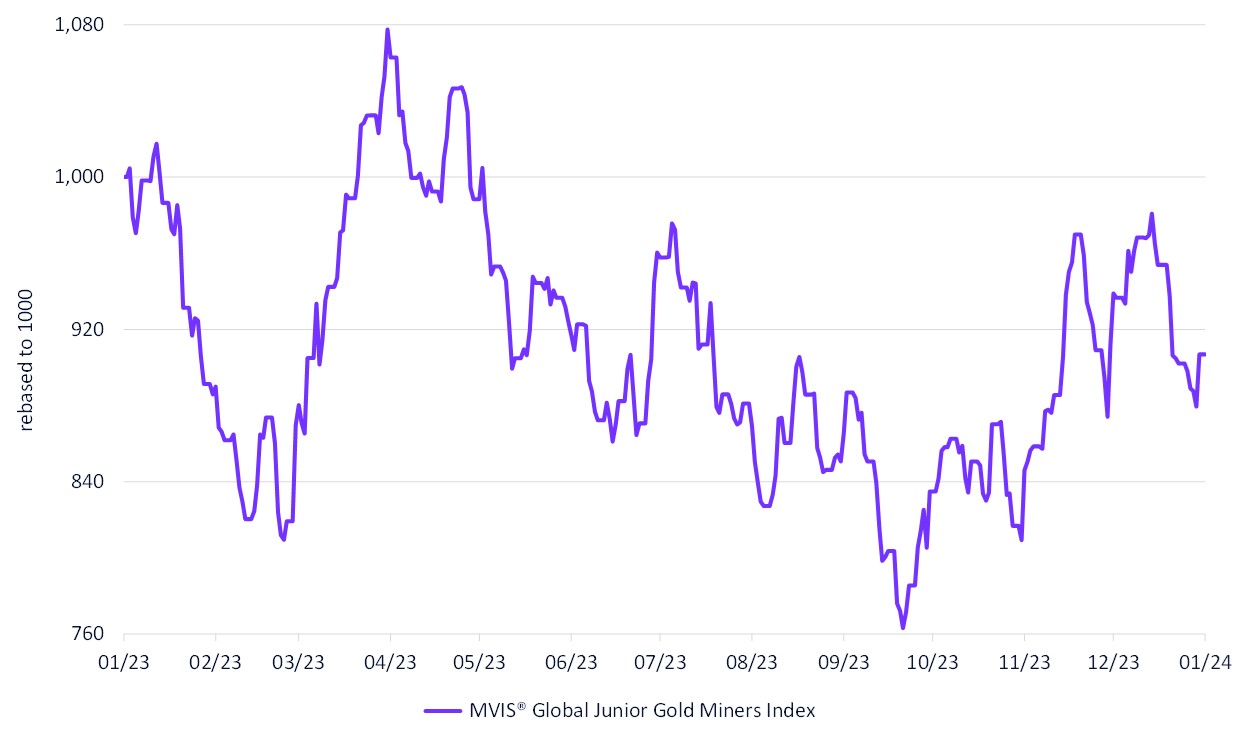

MVIS® Global Junior Gold Miners Index

1/14/2023-1/14/2024

Source: MarketVector IndexesTM. All values are rebased to 1,000. Data as of January 14, 2024.

About the Author:

Ima Casanova joined VanEck in 2011. Prior to VanEck, Ima was Managing Director and Senior Equity Research Analyst at McNicoll Lewis & Vlak and established the firm's metals and mining research department. Previously, she was an Equity Research Analyst at Barnard Jacobs Mellet USA and BMO Capital Markets and held positions as a Production Technologist, Offshore Wellsite Supervisor, and Petroleum Engineer for Shell Exploration and Production. Ima has both an MS and a BS (magna cum laude) in Mechanical Engineering from Case Western Reserve University.

For informational and advertising purposes only. The views and opinions expressed are those of the authors but not necessarily those of MarketVector Indexes GmbH. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts, and other forward-looking statements, that do not reflect actual results. It is not possible to invest directly in an index. Exposure to an asset class represented by an index is available through investable instruments based on that index. MarketVector Indexes GmbH does not sponsor, endorse, sell, promote, or manage any investment fund or other investment vehicle that is offered by third parties and that seeks to provide an investment return based on the performance of any index. The inclusion of a security within an index is not a recommendation by MarketVector Indexes GmbH to buy, sell, or hold such security, nor is it considered to be investment advice.