This is the first article in our new series, Hidden GEMs: Frontier Markets and Beyond, in which we take a snapshot of an overlooked country or frontier market from the point of view of our indexes.

Located on the northern coast of South America, the Cooperative Republic of Guyana, a former British colony that gained independence in 1960, has recently captured global attention for two major reasons: the discovery of substantial oil reserves off its coast since 2015, and Venezuela's claim to a substantial portion of Guyana's western territory. The discovery of oil reserves has particularly garnered attention, making Guyana a country worth examining. Currently, Guyana is ranked 97th in The Heritage Foundation's Index of Economic Freedom.

The Guyana Stock Exchange (GSE) and its main sectors

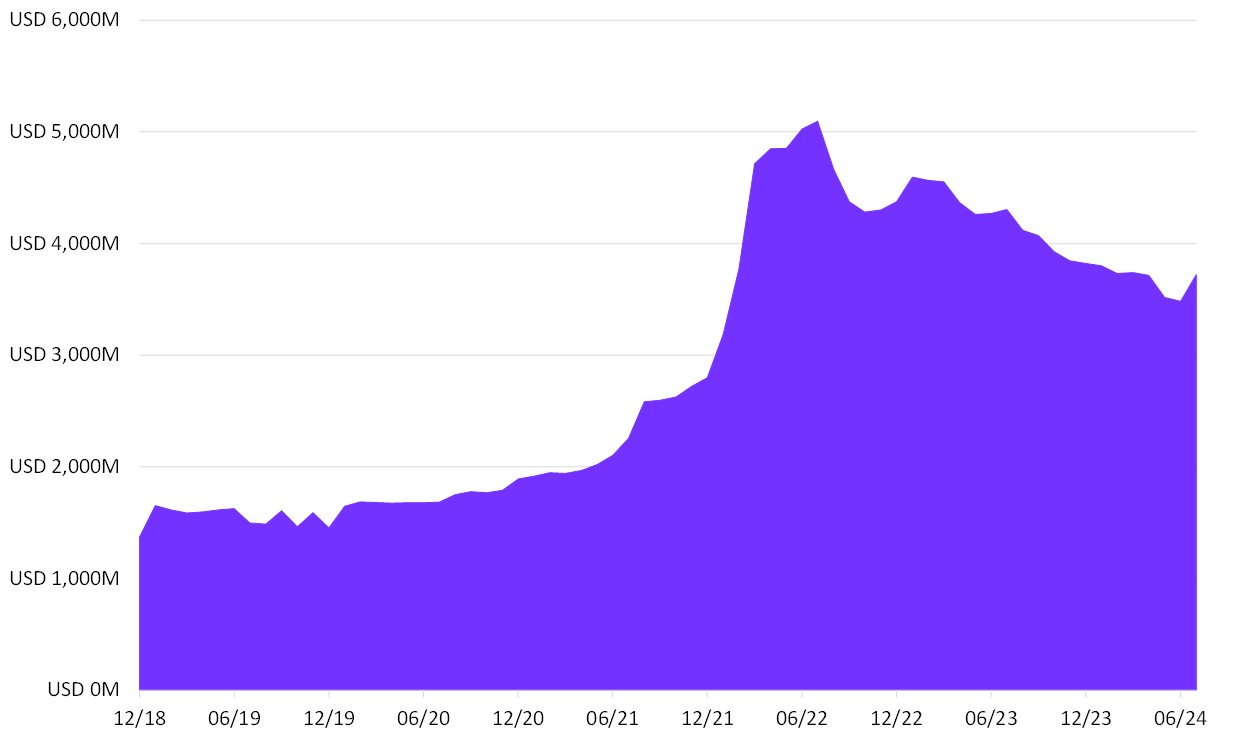

With a population of less than one million, the Guyana Stock Exchange (GSE) is relatively small in terms of market capitalization and liquidity. The exchange lists only 19 companies and operates just once a week to concentrate liquidity. Unlike other frontier markets where e-banking, telecommunications, or electricity sectors dominate, Guyana's largest and most liquid companies are in the food and beverage and tobacco sectors. Specifically, the MarketVectorTM Total Global Equity Index (MVTGLE) includes Banks DIH Ltd. (a food and beverage company) and Demerara Tobacco Company Ltd. Notably, two large banks nearly met the liquidity requirements but fell short.

MarketVector’s Inclusion

The inclusion of local firms like Banks DIH Ltd. and Demerara Tobacco Company Ltd. in MVTGLE highlights Guyana’s unique investment landscape. Despite substantial economic growth, recent geopolitical tensions with Venezuela—intensified by a 2023 referendum where 95% of Venezuelan voters approved creating a new state in the disputed area—have led to a decline in stock prices.

Source: Guyana Stock Exchange (mcap), ICE (FX).

Current Components in MVTGLE

MVTGLE's selection mirrors MarketVector's adeptness at identifying robust local entities while adhering to liquidity requirements.

By incorporating key local companies that meet stringent liquidity requirements, MarketVector bolsters the MarketVectorTM Total Global Equity Index (MVTGLE). This approach not only underscores the potential of Guyana as an investment destination but also supports institutional investors and financial advisors in their search for untapped opportunities.

Get the latest news & insights from MarketVector

Get the newsletterRelated:

About the Author:

Thomas Kettner is the Chief Operating Officer (COO) at MarketVector with global responsibility for the company's index business. Thomas is an indexing expert with more than 15 years of experience in the development and maintenance of indexes, focusing on developing indexes designed for financial products. He is supported by a team of more than 15 index specialists experienced in index administration and maintenance. Prior to joining MarketVector in 2012, he held various positions at leading index providers such as Dow Jones Indexes and STOXX Ltd. Thomas has a degree in Economics from the University of Konstanz, Germany, and is a CIIA graduate.

For informational and advertising purposes only. The views and opinions expressed are those of the authors but not necessarily those of MarketVector Indexes GmbH. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts, and other forward-looking statements, that do not reflect actual results. It is not possible to invest directly in an index. Exposure to an asset class represented by an index is available through investable instruments based on that index. MarketVector Indexes GmbH does not sponsor, endorse, sell, promote, or manage any investment fund or other investment vehicle that is offered by third parties and that seeks to provide an investment return based on the performance of any index. The inclusion of a security within an index is not a recommendation by MarketVector Indexes GmbH to buy, sell, or hold such security, nor is it considered to be investment advice.