Nestled in Southern Africa, Namibia gained independence from South Africa in 1990 and now boasts a population of approximately 3 million. Despite its relatively small economy, Namibia’s unique economic landscape is driven by mining, tourism, and agriculture. Ranked 96th in The Heritage Foundation’s 2024 Index of Economic Freedom1, Namibia offers intriguing opportunities for investors willing to look beyond traditional indicators.

The Namibian Stock Exchange (NSX) and Its Landscape

The Namibian Stock Exchange (NSX) is one of Africa's largest by market capitalization, exceeding USD 140 billion1. However, only about USD 2 billion of this valuation pertains to local companies. The majority of the exchange's market cap stems from secondary listings of foreign companies, especially South African firms like FirstRand Ltd. and Standard Bank Group Ltd., along with mining companies such as Anglo American PLC, B2Gold Corp., and Paladin Energy Ltd.

MarketVector's Approach to Inclusion

MarketVector’s approach includes Namibian equities in the MarketVectorTM Total Global Equity Index (MVTGLE). Out of 40 listings on the NSX, only 15 are considered localwhile the rest are attributed to their respective home countries.

Current Components of MVTGLE

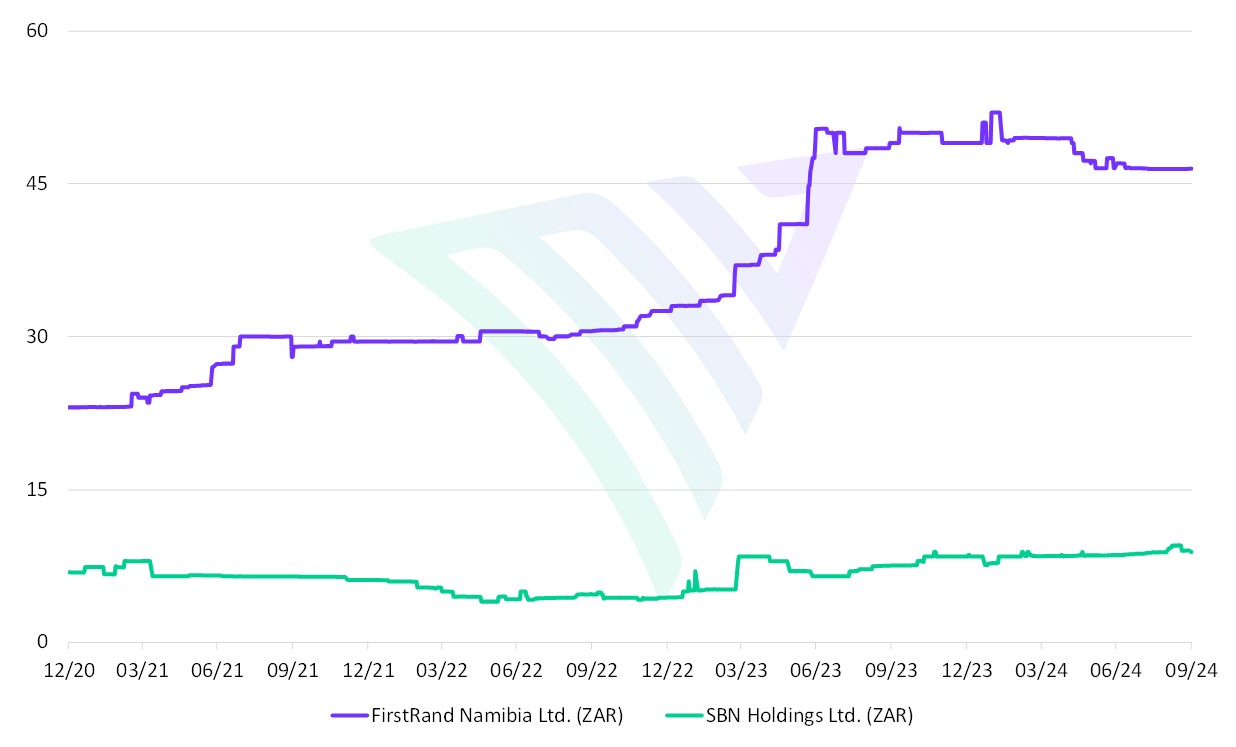

The MVTGLE presently includes two prominent Namibian components: FirstRand Namibia Ltd. and SBN Holdings Ltd. Both are majority-owned by South African parents (FirstRand and Standard Bank Group, respectively), ensuring they bring substantial presence and liquidity to the index.

Exhibit: 5-Years chart of FRN and SBN in ZAR

Source: Namibia stock exchange.

Source1: As of September 1, 2024. A lower rank number is considered better.

These considerations help enhance the MarketVectorTM Total Global Equity Index (MVTGLE) while underscoring Namibia's particular investment opportunities.

Get the latest news & insights from MarketVector

Get the newsletterRelated:

About the Author:

Thomas Kettner is the Chief Operating Officer (COO) at MarketVector with global responsibility for the company's index business. Thomas is an indexing expert with more than 15 years of experience in the development and maintenance of indexes, focusing on developing indexes designed for financial products. He is supported by a team of more than 15 index specialists experienced in index administration and maintenance. Prior to joining MarketVector in 2012, he held various positions at leading index providers such as Dow Jones Indexes and STOXX Ltd. Thomas has a degree in Economics from the University of Konstanz, Germany, and is a CIIA graduate.

For informational and advertising purposes only. The views and opinions expressed are those of the authors but not necessarily those of MarketVector Indexes GmbH. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts, and other forward-looking statements, that do not reflect actual results. It is not possible to invest directly in an index. Exposure to an asset class represented by an index is available through investable instruments based on that index. MarketVector Indexes GmbH does not sponsor, endorse, sell, promote, or manage any investment fund or other investment vehicle that is offered by third parties and that seeks to provide an investment return based on the performance of any index. The inclusion of a security within an index is not a recommendation by MarketVector Indexes GmbH to buy, sell, or hold such security, nor is it considered to be investment advice.