Globalization is in flux – oscillating between globalization and de-globalization forces, with de-globalization currently the prevailing trend. As more nations look to onshore industries, and geo-political trade tensions are on the rise, this trend is not slowing down. These activities will have a divergent impact on multinational global economic companies versus domestic companies.

Multinational global economic companies that have been operating in a globalized economy will face challenges as the trend of slowbalization and onshoring continues. These companies will need to adapt their business models to account for the changing landscape. They may need to move some of their operations back to their home countries, or they may need to find new ways to source their materials and labor.

Domestic companies, on the other hand, may benefit from the slowbalization and onshoring of activities. These companies will have a greater opportunity to compete with multinational global economic companies. Additionally, domestic companies may be able to take advantage of government incentives to bring jobs back to their home countries.

Increased cycles of global vs domestic dominance will drive divergence within the country and regional performance. Using country or regional indexes structured around economic exposure provides investors with a more precise, targeted investment solution for a world in flux.

MarketVectorTM’s global and local index pairs from the MarketVectorTM Economic Exposure Index family bring these concepts to life.

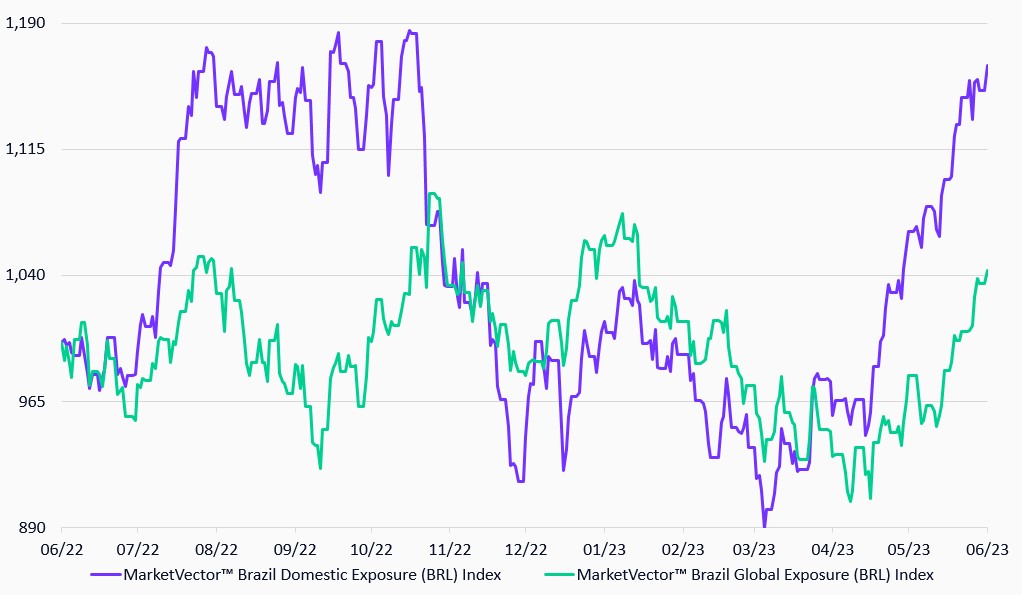

MarketVectorTM Brazil Domestic Exposure Outperforming Global Exposure

19/6/2022-19/6/2023

Source: MarketVector IndexesTM. Data as of June 19, 2023.

For more about MarketVector’s Economic Exposure Indexes,

Read the latest paper published in The Journal of Beta Investment Strategies – Volume 14 Issue 2, May 31, 2023.

Watch the latest video posted on ETFTV and ETFGI, an interview with Deborah Fuhr and Steven Schoenfeld, June 2023.

For more information on our family of indexes, visit www.marketvector.com.

About the Author:

Joy Yang is Head of Product Management and Marketing at MarketVector IndexesTM. She is responsible for managing MarketVector IndexesTM products and services to accelerate innovation in financial index design and adoption. Joy brings more than 25 years of investment experience to MarketVector IndexesTM, having led teams delivering index and quantitative-active investment solutions at Arabesque Asset Management, Dimensional Fund Advisors, Vanguard, Aberdeen Standard Investments, AXA Rosenberg, and Blackrock. Joy has an MBA from the University of Chicago Booth School of Business and a BS in Electrical Engineering from Cooper Union’s Albert Nerken School of Engineering.

For informational and advertising purposes only. The views and opinions expressed are those of the authors but not necessarily those of MarketVector Indexes GmbH. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts, and other forward-looking statements, which do not reflect actual results. It is not possible to invest directly in an index. Exposure to an asset class represented by an index is available through investable instruments based on that index. MarketVector Indexes GmbH does not sponsor, endorse, sell, promote, or manage any investment fund or other investment vehicle that is offered by third parties and that seeks to provide an investment return based on the performance of any index. The inclusion of a security within an index is not a recommendation by MarketVector Indexes GmbH to buy, sell, or hold such security, nor is it considered to be investment advice.