The “Efficient Market Hypothesis” (EMH)1 states that asset prices reflect all available information. But some markets are more efficient than others.

The continuous pricing advantage of Crypto markets

Digital assets trade on crypto exchanges 24 hours, seven days a week (24/7). This continuous pricing means that new, unexpected information can be instantly reflected in its price. Unlike traditional markets, there are no closing hours, no weekends, and no holidays that delay price discovery. Even futures contracts, which are forward-looking because they represent things that will happen in the future, do not trade 24/7.

Implications of higher market efficiency

Market efficiency implies that consistently outperforming the market is challenging. The investment implications of higher market efficiency include ensuring that all participants have equal access to information, reducing transaction costs, and promoting effective risk management. This benefits the entire financial ecosystem, leveling the playing field, not just favoring those with access to proprietary information.

Bitcoin’s response to unexpected news

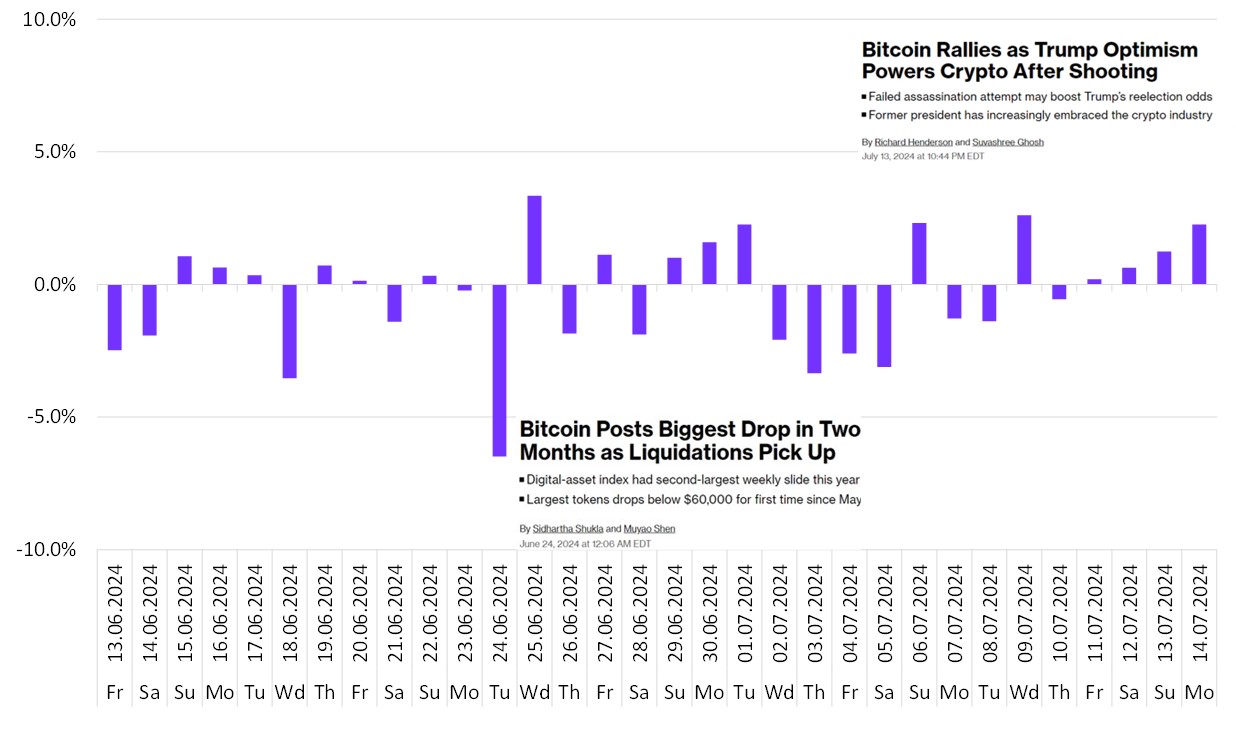

We can look at Bitcoin prices, using MarketVectorTM Bitcoin Benchmark Rate (BBR). We can see that, over the previous 30-day period, Bitcoin reacted to new, unexpected news announcements 24/7, including events over the weekend such as the assassination attempt on Trump on Sunday, July 14, 2024.

Bitcoin’s ability to trade continuously allows it to respond to new information almost instantaneously, achieving a higher level of price efficiency. The 24/7 nature of digital asset trading presents a compelling case for reconsidering the traditional market structures in achieving true market efficiency.

MarketVectorTM Bitcoin Benchmark Rate (BBR) Daily Price Change

Source: MarketVector. Data as of July 15, 2024.

Source1: Fama, Eugene (1970). "Efficient Capital Markets: A Review of Theory and Empirical Work". Journal of Finance

For more information on our family of indexes, visit www.marketvector.com.

Joy Yang is the Head of Product Management and Marketing at MarketVector. She is responsible for managing MarketVector products and services to accelerate innovation in financial index design and adoption. Joy brings more than 25 years of investment experience to MarketVector, having led teams delivering index and quantitative-active investment solutions at Arabesque Asset Management, Dimensional Fund Advisors, Vanguard, Aberdeen Standard Investments, AXA Rosenberg, and Blackrock. She has an MBA from the University of Chicago Booth School of Business and a Bachelor of Science in Electrical Engineering from Cooper Union’s Albert Nerken School of Engineering.

For informational and advertising purposes only. The views and opinions expressed are those of the authors but not necessarily those of MarketVector Indexes GmbH. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts, and other forward-looking statements, that do not reflect actual results. It is not possible to invest directly in an index. Exposure to an asset class represented by an index is available through investable instruments based on that index. MarketVector Indexes GmbH does not sponsor, endorse, sell, promote, or manage any investment fund or other investment vehicle that is offered by third parties and that seeks to provide an investment return based on the performance of any index. The inclusion of a security within an index is not a recommendation by MarketVector Indexes GmbH to buy, sell, or hold such security, nor is it considered to be investment advice.

Get the latest news & insights from MarketVector

Get the newsletterRelated: