August 2014

by Prof. Dr. Edward I. Altman

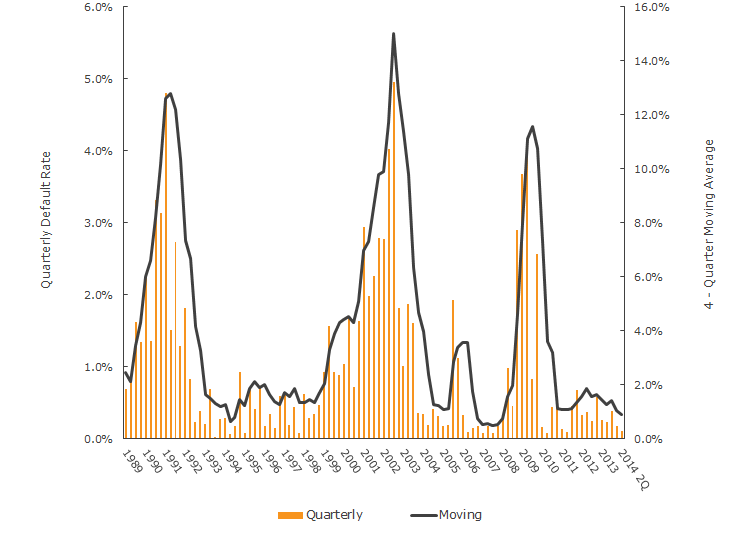

The benign credit cycle in the U.S. is now mid-way through its fifth consecutive year of well below average annual default rates on high-yield (HY) bonds. Benign cycles typically last for 5-7 years, followed by default rates exploding to above 10%. The market currently shows clear signs of a bubble building, perhaps primed to burst in 2015-17. New issuance of HY bonds has been at or near record levels since 2010, with an increasing proportion offering little to no safeguards to investors who today seem content with promised yields of roughly only 1% above the all-time lowest spread (June 2007), just prior to the onset of the great financial crisis.

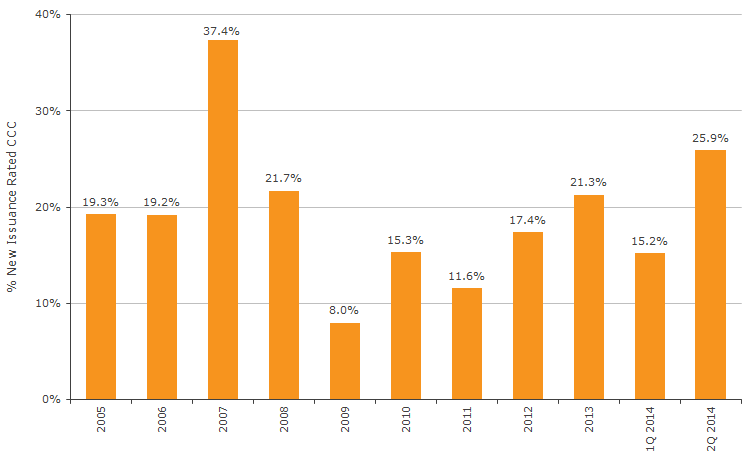

In the second quarter of 2014, the proportion of new issuance at the most risky level (CCC) reached near 30%, second only again to the level in 2007. History shows that approximately 50% of CCC bonds default by the fifth year after issuance – is this time different?

Default Rates on High-Yield Bonds:

Quarterly Default Rates and Four-Quarter Moving Average, 1989-1H 2014

Source: NYU Salomon Center

U.S. High-Yield Bond Market: CCC Rated Issuance, 2005-2014 (30 June)

Source: Bank of America Merrill Lynch

About the Author:

Dr. Altman is the Max L. Heine Professor of Finance at the NYU Stern School of Business and Director of the Fixed Income Credit & Debt Markets Research Program at the NYU Salomon Center. He created the Altman Z-Score model for bankruptcy prediction, and is a member of the Fixed Income Analysts Society and the Turnaround Management Association's Halls of Fame.

The article above is an opinion of the author and does not necessarily reflect the opinion of MV Index Solutions or its affiliates.