BRICS refers to the bloc of countries consisting of Brazil, Russia, India, China, and South Africa, united to promote common goals and objectives. This year, in their annual summit, they announced the addition of six new members: Iran, Saudi Arabia, United Arab Emirates, Argentina, Egypt, and Ethiopia. This expansion has the potential to bolster an alternative to established international alliances and groups dominated by the United States, putting another “Brick in the Wall” (Pink Floyd) between traditional power dynamics and a more multi-polar world order.

The expansion of BRICS could lead to a more pronounced differentiation in the impact on global versus domestically oriented companies within a region or country. This divergence could, in turn, contribute to a bifurcation of performance within countries or regions.

The concept of using country or regional indexes that are structured around economic exposure is relevant in this context. These indexes can be used by investors to align their investment solutions with their macro views and allow for a more nuanced understanding of global economic trends.

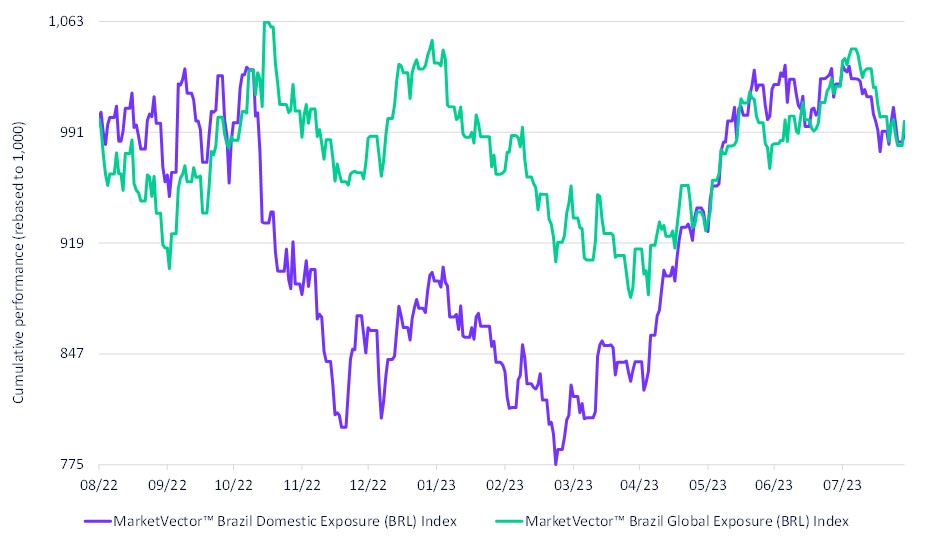

MarketVector’s Economic Exposure Indexes series, which includes the MarketVector™ Brazil Global Exposure (BRL) Index and the MarketVector™ Brazil Domestic Exposure (BRL) Index, segments Brazilian companies into Global or Domestic indexes by their source of revenue. These indexes bring the macro impact on performance difference to life.

MarketVectorTM Brazil Domestic Exposure (BRL) Index vs MarketVectorTM Brazil Global Exposure (BRL) Index

8/28/2022-8/28/2023

Source: MarketVector. Data as of August 28, 2023.

For more information on our family of indexes, visit www.marketvector.com.

Joy Yang is the Head of Product Management and Marketing at MarketVector. She is responsible for managing MarketVector products and services to accelerate innovation in financial index design and adoption. Joy brings more than 25 years of investment experience to MarketVector, having led teams delivering index and quantitative-active investment solutions at Arabesque Asset Management, Dimensional Fund Advisors, Vanguard, Aberdeen Standard Investments, AXA Rosenberg, and Blackrock. She has an MBA from the University of Chicago Booth School of Business and a Bachelor of Science in Electrical Engineering from Cooper Union’s Albert Nerken School of Engineering.

For informational and advertising purposes only. The views and opinions expressed are those of the authors but not necessarily those of MarketVector Indexes GmbH. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts, and other forward-looking statements, that do not reflect actual results. It is not possible to invest directly in an index. Exposure to an asset class represented by an index is available through investable instruments based on that index. MarketVector Indexes GmbH does not sponsor, endorse, sell, promote, or manage any investment fund or other investment vehicle that is offered by third parties and that seeks to provide an investment return based on the performance of any index. The inclusion of a security within an index is not a recommendation by MarketVector Indexes GmbH to buy, sell, or hold such security, nor is it considered to be investment advice.