It is no secret that mining companies face many risks related to the regions where they operate. However, it is important (and necessary, if you want to invest in the sector) to differentiate between broader jurisdiction risk and risk to mining operations.

At the recent BMO Global Metals, Mining, and Critical Minerals Conference, we met with companies with operations and/or projects in regions that are most certainly considered geopolitically risky jurisdictions, yet their managements are comfortable with their ability to operate and enjoy stability in these countries. These included Peru, Ecuador, Guyana, Nicaragua, PNG, and Ethiopia.

Ivory Coast and Guinea appear to be broadly considered pockets of stability in the complex West African region. West Africa, a challenging jurisdiction due to its geopolitical landscape, continues to be one of the best regions to discover and develop gold resources from an exploration, permitting, labor, and capital efficiency point of view.

While more cautious about ongoing changes and developments in Argentina, Colombia, and Mexico, the general feeling on the outlook of these countries seemed to be mostly optimistic from a gold mining operating and investment perspective.

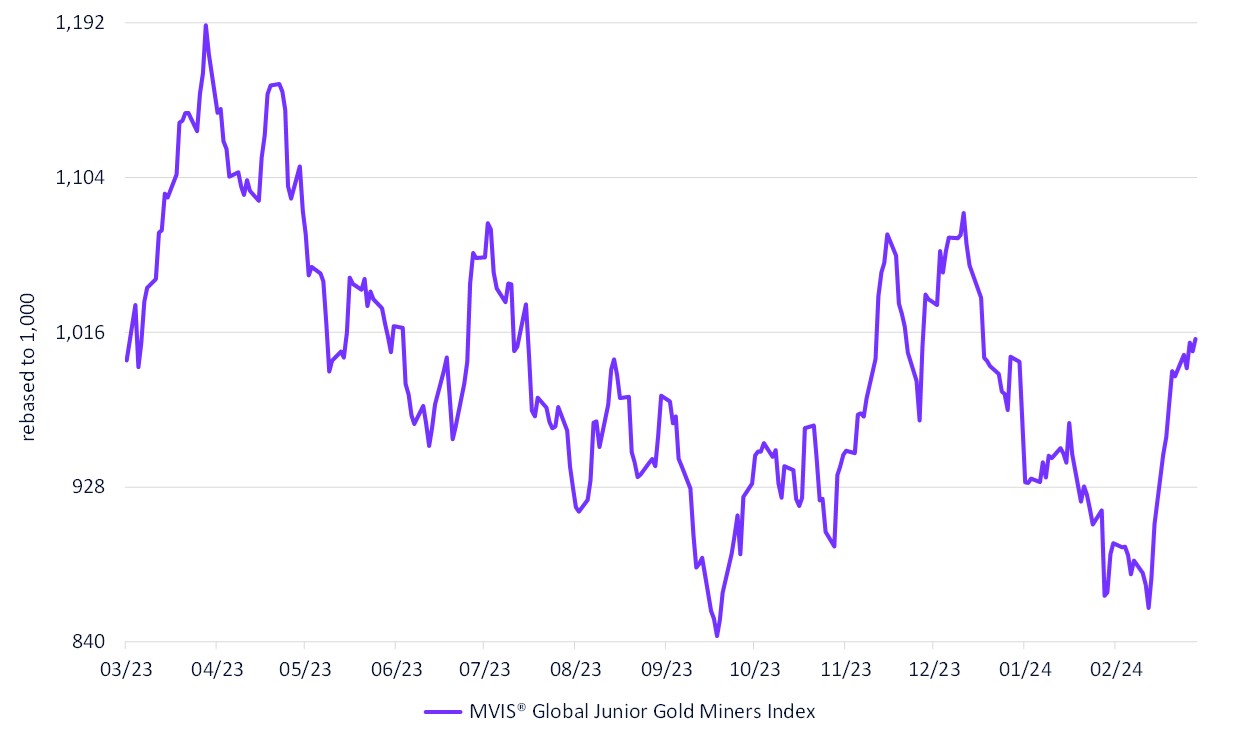

MVIS® Global Junior Gold Miners Index

3/17/2023 - 3/17/2024

Source: MarketVector. All values are rebased to 1,000. Data as of March 17, 2024.

For more information on our family of indexes, visit www.marketvector.com.

About the Author:

Ima Casanova joined VanEck in 2011. Prior to VanEck, Ima was Managing Director and Senior Equity Research Analyst at McNicoll Lewis & Vlak and established the firm's metals and mining research department. Previously, she was an Equity Research Analyst at Barnard Jacobs Mellet USA and BMO Capital Markets and held positions as a Production Technologist, Offshore Wellsite Supervisor, and Petroleum Engineer for Shell Exploration and Production. Ima has both an MS and a BS (magna cum laude) in Mechanical Engineering from Case Western Reserve University.

For informational and advertising purposes only. The views and opinions expressed are those of the authors but not necessarily those of MarketVector Indexes GmbH. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts, and other forward-looking statements, that do not reflect actual results. It is not possible to invest directly in an index. Exposure to an asset class represented by an index is available through investable instruments based on that index. MarketVector Indexes GmbH does not sponsor, endorse, sell, promote, or manage any investment fund or other investment vehicle that is offered by third parties and that seeks to provide an investment return based on the performance of any index. The inclusion of a security within an index is not a recommendation by MarketVector Indexes GmbH to buy, sell, or hold such security, nor is it considered to be investment advice.