As Taylor Swift's mania sweeps the globe, her hit song \Shake It Off\ strikes a chord in the world of thematic indexing. This quarter, thematic indexes, much like broader markets, have hit a sour note with negative returns. But just as Swift shakes off criticism and makes a strong comeback, investors monitoring and investing in thematics should shake off short-term volatility and refocus on the long-term outlook and case for indexing thematics. These challenges, while daunting, underscore the enduring melody of investing in thematics - the unique benefits and opportunities they present.

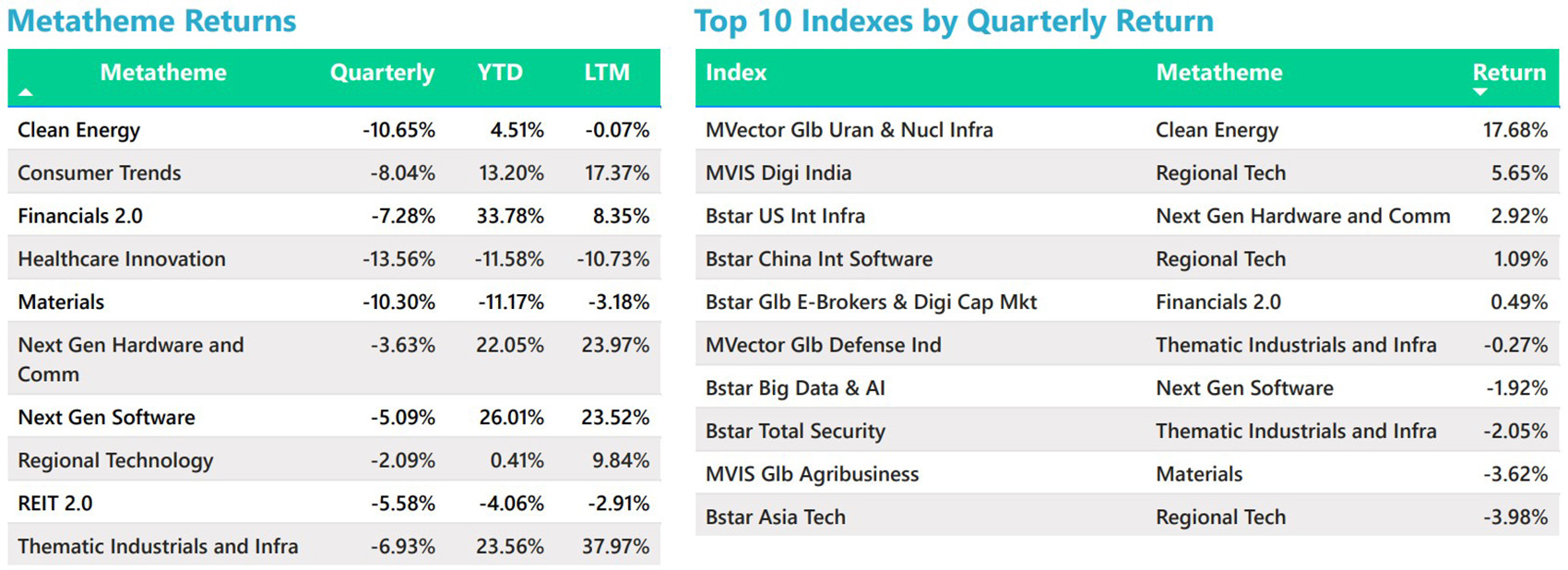

Thematic indexes linked to structural changes and macro shifts can experience short-term underperformance. Investors focused on the long-term investment rationale and invested across uncorrelated themes can benefit from diversification. As we see in the following tables, despite the overall negative performance, there were individual thematic index outperformance (MarketVectorTM Gl. Uranium and Nuclear Energy Infrastructure Index +18%) as well as long-term (last 12 months LTM) meta-theme outperformance (Thematic Industrials and Infrastructure, amongst other meta themes). The latest MarketVector Thematic Quarterly Chartpack provides a bird’s eye view of trends in the global equity markets through a thematic lens. We’ve organized our family of thematic indexes into ten meta themes so investors can get a sense of the performance of which megatrends are leading or lagging, while also being able to discover the leading indexes and individual stocks within those broader themes.

Thematic Index Performance ending September 30, 2023

Source: MarketVector. Data as of September 30, 2023.

For more information on our family of indexes, visit www.marketvector.com.

Watch our latest video on Thematic Indexing here.

Joy Yang is the Head of Product Management and Marketing at MarketVector. She is responsible for managing MarketVector products and services to accelerate innovation in financial index design and adoption. Joy brings more than 25 years of investment experience to MarketVector, having led teams delivering index and quantitative-active investment solutions at Arabesque Asset Management, Dimensional Fund Advisors, Vanguard, Aberdeen Standard Investments, AXA Rosenberg, and Blackrock. She has an MBA from the University of Chicago Booth School of Business and a Bachelor of Science in Electrical Engineering from Cooper Union’s Albert Nerken School of Engineering.

For informational and advertising purposes only. The views and opinions expressed are those of the authors but not necessarily those of MarketVector Indexes GmbH. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts, and other forward-looking statements, that do not reflect actual results. It is not possible to invest directly in an index. Exposure to an asset class represented by an index is available through investable instruments based on that index. MarketVector Indexes GmbH does not sponsor, endorse, sell, promote, or manage any investment fund or other investment vehicle that is offered by third parties and that seeks to provide an investment return based on the performance of any index. The inclusion of a security within an index is not a recommendation by MarketVector Indexes GmbH to buy, sell, or hold such security, nor is it considered to be investment advice.

Get the latest news & insights from MarketVector

Get the newsletterRelated: