On June 3, Senator Mark Warner (D-VA) introduced the Intelligence Authorization Act for Fiscal Year 2025 (S.4443) to the Senate Select Committee on Intelligence.1 The bill passed unanimously 17-0 within the committee, moving towards wider Senate approval, and focuses primarily on intelligence and intelligence-related spending by the U.S. government for the 2025 fiscal year. Unbeknownst to industry insiders and other policymakers alike, the bill contained Section 432 on Terrorist Financing Prevention, which defines digital assets and outlines a mandatory identification of and sanctions for “foreign digital asset transaction facilitators” that have engaged with recognized terrorist organizations. Its vague language caused concern and immediate pushback within the industry.

This is only the latest in a series of steps taken by U. S. lawmakers towards regulations on decentralized finance (DeFi) and digital assets. In late April, Senators Elizabeth Warren (D-MA) and Roger Marshall (R-KS) wrote a letter to members of the Biden Administration warning about bad actors, such as North Korea, Iran, and Russia, evading sanctions through the use of cryptocurrency, and expressing general concerns about the threats that crypto poses to national security.2

As the US government considers imposing restrictions on digital assets, key regulators, like the Securities and Exchange Commissions (SEC) and the Commodity Futures Trading Commission (CFTC), have also scrutinized cryptocurrency. SEC chair Gary Gensler has insinuated that cryptocurrency exchange platforms are likely trading what can be considered as securities, in violation of securities law by remaining unregistered and not disclosing information to the public.3 CFTC Chief Rostin Behnam firmly believes that crypto tokens are considered commodities and that his agency should have greater control over their regulation.4 Both Gensler and Benham argue that the U.S. does not currently have the legislative infrastructure or regulatory framework in order to bring transparency to the digital asset space and keep markets stable.

At the end of May, the U.S. House of Representatives passed H.R. 4763, the Financial Innovation and Technology for the 21st Century Act (“FIT21”), which is a step towards providing the “regulatory clarity and robust consumer protections necessary for the digital asset ecosystem to thrive in the United States”.5 The bill divided the delegated responsibility of managing regulations between the SEC and the CFTC.

The Biden Administration has not been unfriendly to cryptocurrency, as seen in the March 2022 Executive Order on Ensuring Responsible Development of Digital Assets,6 but has remained skeptical. Conversely, Donald Trump has made countless pro-cryptocurrency statements in recent weeks, even calling for U.S. dominance in the crypto mining sector. Digital assets and the world of DeFi as a whole are slated to be a contentious topic ahead of the upcoming Presidential Election in November.

While sanctions against crypto in S.4443 are unlikely to pass in the next draft of the bill as it heads to the Senate, partially due to the negative response from the cryptocurrency camp, it serves as an important reminder of the ever-changing landscape of and opinion on decentralized finance.

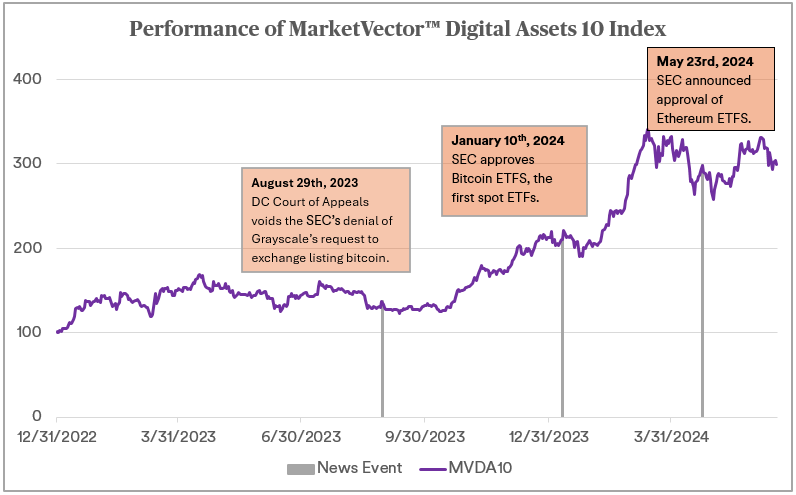

On August 29, 2023, a District of Columbia Court of Appeals ruled to approve the exchange listing of bitcoin on the New York Stock Exchange in a move that vacates the issued denial order of the SEC.7 In a rare move, the SEC approved spot ETFs in January of 2024,8 and announced on June 13 that administrative requirements are currently in process for Ethereum’s ether ETF (ETH). Interestingly, we can examine the effects that these announcements and S.4443 in the 2025 Intelligence Authorization Act have had on the crypto markets.

Source: MarketVector. Data as of June 17, 2024.

Keeping a close eye on any and all forthcoming decisions on DeFi out of Congress will be imperative in understanding the way that the industry will move forward. If the government implements strict regulations, this could increase investment in digital asset ETFs. Laws employing inflexible language, similar to that in S.4443, could cause those trading on cryptocurrency exchanges to switch over to crypto ETFs, which are compliant with U.S. laws and regulations. Similarly, the 2024 election could be a powerful kindling in regulation of the DeFi industry as both Democrats and Republics race to prove who is the most accepting of digital assets and cryptocurrency in order to garner public support. The unchartered waters of digital assets have no indication just yet as to how they will respond to inevitable regulation, but watching the markets can help understand the precedents as they are set.

Source1: https://www.congress.gov/bill/118th-congress/senate-bill/4443/text

Source3: https://www.sec.gov/news/statement/gensler-statement-spot-bitcoin-011023

Source4: https://www.cftc.gov/PressRoom/SpeechesTestimony/opabehnam41

Source5: https://financialservices.house.gov/news/documentsingle.aspx?DocumentID=409251

Source8: https://www.sec.gov/news/statement/gensler-statement-spot-bitcoin-011023

For more information on our family of indexes, visit www.marketvector.com.

Get the latest news & insights from MarketVector

Get the newsletterRelated: