The global steel industry is suffering from significant overcapacity. And China continues to roll out steel with abandon. But for U.S. steel companies all is not doom and gloom.

In March, the U.S. Department of Commerce announced that both government subsidies and dumping were occurring. It levied tariffs in the range of 282% to 493%, more than enough to lock out Chinese steel from the U.S. market.

We see three positive signs for the steel industry in the U.S. in particular:

- The continuation of a strengthening U.S steel environment;

- Fundamentally better operating and financial conditions (via improved capacity utilization); and

- The potential for industry-wide multiple rerating, which has not happened in a long time.

While the U.S. steel industry has already performed well this year, we believe the opportunity has more near-term up-side potential as the enforcement of all trade protection laws is still in its early stages.

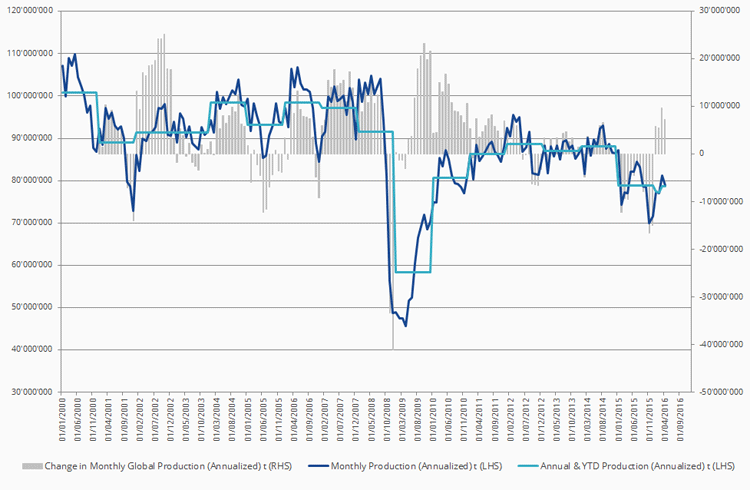

Crude Steel Production: United States

Source: VanEck Research and Bloomberg

About the Author:

Charl P. de M. Malan is a Senior Analyst at VanEck specializing in base and industrial metals, coal and steel. Before joining VanEck, Mr. Malan was an equity research sales analyst specializing in South African mining, natural resources, and financial sectors at JPMorgan Chase. He was previously an equity research analyst and junior portfolio manager at Standard Corporate and Merchant Bank, Asset Management (South Africa).

The article above is an opinion of the author and does not necessarily reflect the opinion of MV Index Solutions or its affiliates.