Gold producing companies are financially strong, and able to fund their growth plans. However, the markets do not seem to like companies spending to find, develop and build mines. Whether it is through an acquisition of an asset or another company, or through the development of one of the company’s assets, the market seems to generally punish the gold stocks on announcements of significant spending towards growth.

However, for companies to continue to create value, they must invest in growth. While growth at any cost is a thing of the past, growth at zero cost is fantasy. The current inflationary environment is complicating things further for the gold sector. Building a mine requires a lot of materials, energy, labor and capital. Capex estimates for new projects are being revised up 20-30% due to cost inflation. The market naturally is spooked by such news, so stocks generally drop when the revisions are announced.

But in reality, in their quest to demonstrate that they can run profitable and sustainable businesses with good returns through the economic cycles, the gold companies have no choice but to explore, build and expand/upgrade mines—even during periods of high inflation. It takes a long time (typically ten or more years) to discover, permit, develop and put a gold deposit in production. Those companies that can manage to do so while maintaining attractive returns should outperform.

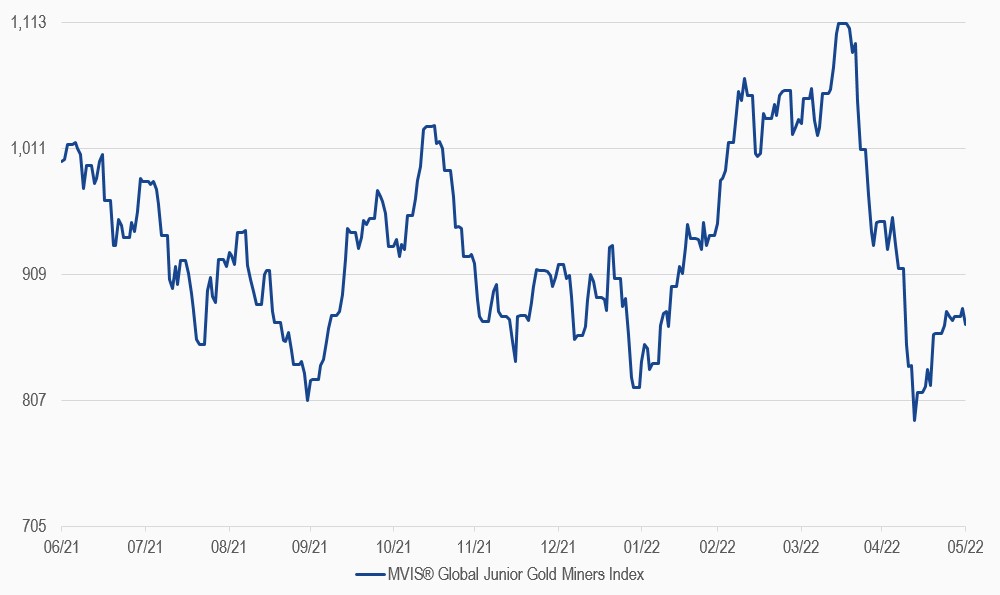

MVIS® Global Junior Gold Miners Index

6/30/2021-6/30/2022

Source: MarketVector Indexes. All values are rebased to 1,000. Data as of June 30, 2022.

About the Author:

Ima Casanova joined VanEck in 2011. Prior to VanEck, Ima was Managing Director and Senior Equity Research Analyst at McNicoll Lewis & Vlak and established the firm's metals and mining research department. Previously, she was Equity Research Analyst at Barnard Jacobs Mellet USA and BMO Capital Markets and held positions as Production Technologist, Offshore Wellsite Supervisor and Petroleum Engineer for Shell Exploration and Production. Ima has both an MS and a BS (magna cum laude) in Mechanical Engineering from Case Western Reserve University.

For informational and advertising purposes only. The views and opinions expressed are those of the authors but not necessarily those of MarketVector Indexes GmbH. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. It is not possible to invest directly in an index. Exposure to an asset class represented by an index is available through investable instruments based on that index. MarketVector Indexes GmbH does not sponsor, endorse, sell, promote or manage any investment fund or other investment vehicle that is offered by third parties and that seeks to provide an investment return based on the performance of any index. Inclusion of a security within an index is not a recommendation by MarketVector Indexes GmbH to buy, sell, or hold such security, nor is it considered to be investment advice.