Artificial Intelligence (A.I.) is already a part of our everyday lives. From Alexa to autonomous vehicles, we use A.I. everyday. But many experts see these first steps of A.I. integration as “basic” and are waiting for the next generation of A.I. advancement to further enhance our everyday lives. To that, the global artificial intelligence industry is expected to grow from $59.7 billion in 2021 to $422.4 billion in 2028.

Industry experts believe A.I. will be supplanted everywhere within our daily lives. This could range from investment management to “smart calendars” to grocery shopping. As we see the global investment into A.I. skyrocket with a growth rate of 115% year over year (2021 data), we can expect many subsequent A.I. products and services be integrated into our daily lives in the coming years.

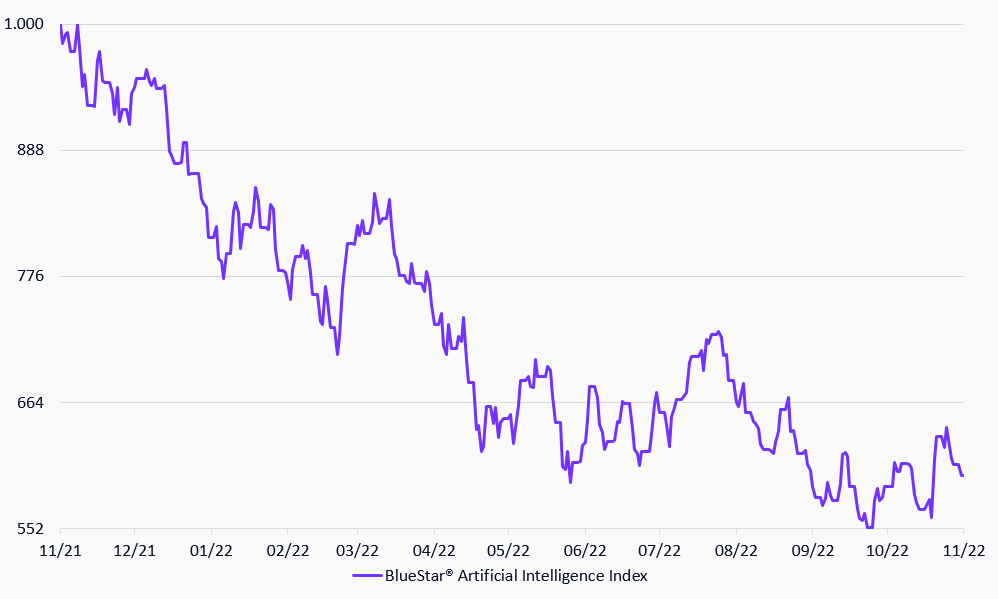

The BlueStar® Artificial Intelligence Index (ticker: BAIPR) tracks the performance of the largest and most liquid companies in the global artificial intelligence industry. This is a modified market cap-weighted index, and only includes companies that generate at least 50% of their revenue from products or services required for either machine learning or inference/'Applied Ai', such as productivity software, big data analytics related to machine learning, embedded machine learning semiconductors, sensors and signal processors for machine vision, natural language processing and voice recognition, or proprietary artificial intelligence software or services.

BlueStar® Artificial Intelligence Index

22/11/2021-22/11/2022

Source: MarketVector IndexesTM. Data as of November 22, 2022.

For more information on our family of indexes, visit us.

About the Author:

Alex Butler is a Business Development Associate at MarketVector Indexes GmbH. At MarketVector IndexesTM, Alex works closely with the business teams and clients to help tailor indexes and index data to meet client needs. Prior to joining MarketVector IndexesTM, Alex led the Americas Business Development team at S&P Global (Formerly IHS Markit, Markit) for ETF and Index Management. Alex is a product expert for ETF and index data. Alex studied at Elon University with a BA in Economics along with a focus on Information Science.

For informational and advertising purposes only. The views and opinions expressed are those of the authors but not necessarily those of MarketVector Indexes GmbH. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. It is not possible to invest directly in an index. Exposure to an asset class represented by an index is available through investable instruments based on that index. MarketVector Indexes GmbH does not sponsor, endorse, sell, promote or manage any investment fund or other investment vehicle that is offered by third parties and that seeks to provide an investment return based on the performance of any index. Inclusion of a security within an index is not a recommendation by MarketVector Indexes GmbH to buy, sell, or hold such security, nor is it considered to be investment advice.