Unfortunately, there were some stranded passengers on the August rollercoaster ride, namely gold stocks, which did not quite recover from the big drop earlier in the month.

When the gold price is declining or consolidating, gold equities tend to underperform. Even when gold rallies, sometimes stocks tend to lag during the early stages of the rally, while markets digest the new outlook for the metal.

Something similar is happening during this recent bounce back in gold prices. The revenues and earnings generated by the companies at the end of August are essentially the same they were a month ago, yet the stocks are trading at significantly lower prices, creating, we believe, a value opportunity.

Gold companies’ operating margins have expanded significantly in recent years. Not only has the gold price reached record highs, but the companies have also reduced and controlled costs, allowing margins to increase to record levels.

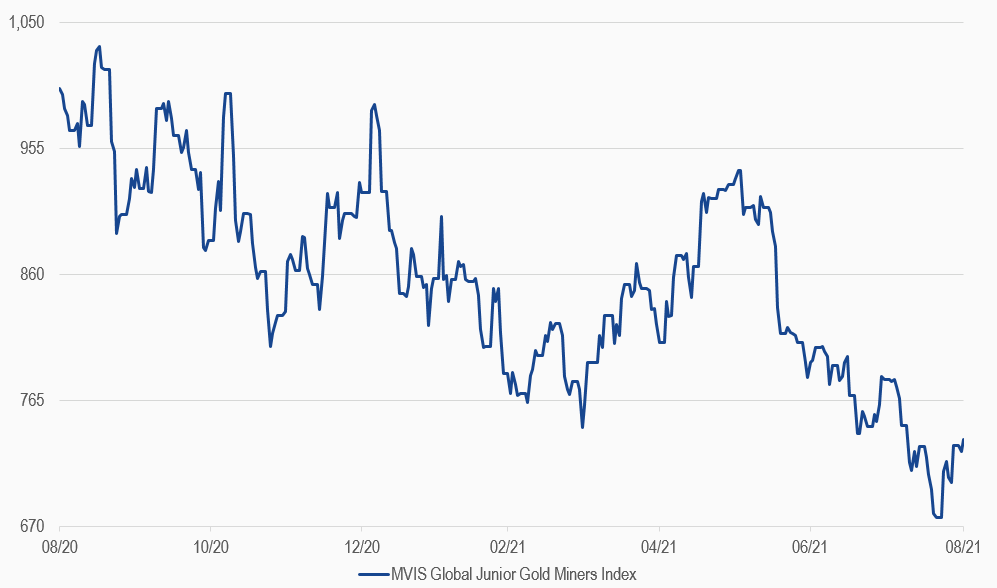

MVIS Global Junior Gold Miners Index

31/08/2020-31/08/2021

Source: MV Index Solutions. All values are rebased to 1,000. Data as of 31 August 2021.

Get the latest news & insights from MarketVector

Get the newsletterRelated: