It is likely a bit too early to say whether the banking crisis in the U.S. is contained or over. At the end of April, the collapse and rescue of yet another bank, First Republic Bank, is clear evidence that risks remain.

Once again, regulators intervened and a more catastrophic failure was averted. However, it is another sign of the current fragility of the global financial system. Even if this was the end of the banking turmoil, which appears unlikely, these recent developments expose the significant stress imposed on the economy by higher interest rates and certainly worsen and accelerate the chances of a recession or hard landing. It also makes it very clear that, like the banks, other sectors of the economy may be vulnerable, increasing uncertainty and volatility in the markets. This is supportive of gold prices.

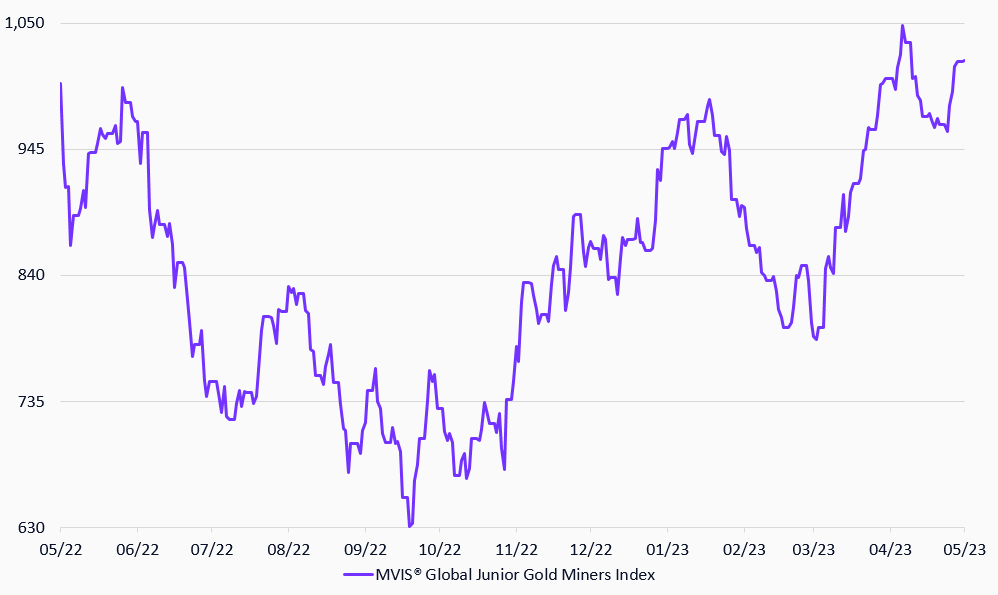

MVIS® Global Junior Gold Miners Index

5/8/2022-5/8/2023

Source: MarketVector IndexesTM. All values are rebased to 1,000. Data as of May 8, 2023.

About the Author:

Ima Casanova joined VanEck in 2011. Before VanEck, Ima was Managing Director and Senior Equity Research Analyst at McNicoll Lewis & Vlak and established the firm's metals and mining research department. Previously, she was Equity Research Analyst at Barnard Jacobs Mellet USA and BMO Capital Markets and held positions as Production Technologist, Offshore Wellsite Supervisor, and Petroleum Engineer for Shell Exploration and Production. Ima has both an MS and a BS (magna cum laude) in Mechanical Engineering from Case Western Reserve University.

For informational and advertising purposes only. The views and opinions expressed are those of the authors but not necessarily those of MarketVector Indexes GmbH. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements herein may constitute projections, forecasts, and other forward-looking statements that do not reflect actual results. It is not possible to invest directly in an index. Exposure to an asset class represented by an index is available through investable instruments based on that index. MarketVector Indexes GmbH does not sponsor, endorse, sell, promote, or manage any investment fund or other investment vehicle that is offered by third parties and that seeks to provide an investment return based on the performance of any index. Including security within an index is not a recommendation by MarketVector Indexes GmbH to buy, sell, or hold such security, nor is it considered investment advice.