In 2023, MarketVector IndexesTM (MarketVector) launched the MarketVectorTM Global Defense Industry Index (MVDEF). Now Europeans have their first mainstream opportunity to invest in defense companies with an Exchange Traded Fund (ETF) tracking the MVDEFTR. The MVDEFTR tracks the performance of companies that are involved in serving national defense industries. Companies must derive 50% (25% for current components) of their revenues from the military or defense industries (including related national/federal governmental departments) related to the following products and services outlined in the Index Guide.

With the ongoing conflict between Russia and Ukraine and the rise of Environmental, Social, and Governance (ESG) aligned investing, investors may have concerns about investing in defense companies, given these companies are associated with environmental damage, human rights abuses, and other negative externalities. However, there are several reasons why investing in defense can be both important and consistent with ESG principles.

- Safeguard peace and security. A strong defense can deter aggression and help to resolve conflicts peacefully. For example, the United States strong military presence in Europe helped to deter the Soviet Union from invading Western Europe during the Cold War.

- Create jobs, boost economic growth, and spark innovation. The defense industry is a major employer in many countries, and it also helps to support several other industries, such as aerospace, manufacturing, and nascent technology (internet, GPS, semiconductor).

- Protect human rights. Staunch defense can help to protect people from violence and oppression. For example, the United Nations peacekeeping forces have helped to protect civilians in conflict zones around the world.

We cannot overlook the potential negative consequences of defense spending. For example, war and conflict can lead to environmental damage, such as the pollution caused by military bases and the use of depleted uranium ammunition. Additionally, military action can lead to human rights abuses, such as the use of torture or extrajudicial killings by military forces. Companies violating norms can be reviewed and excluded using an ESG lens.

The MVDEFTR considers ESG factors as detailed in Index Guide chapter 7.2 (Filters for MVDEF). MarketVector utilizes ESG data provided by Institutional Shareholder Services (ISS ESG). The index does not consider companies that violate certain ESG criteria included in the following categories: Norm-based research, and controversial weapons.

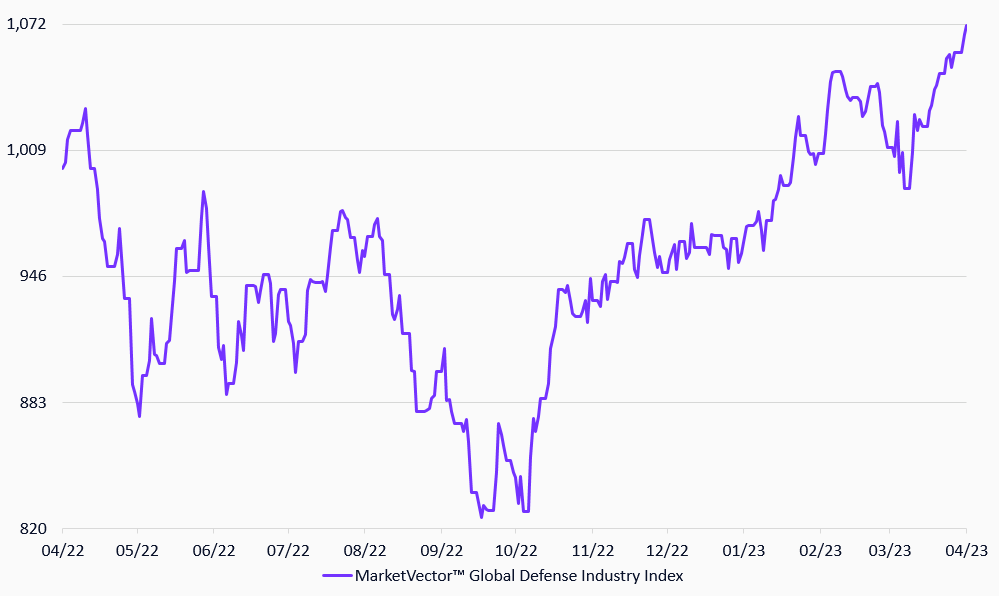

MarketVectorTM Global Defense Industry Index

11/4/2021-11/4/2023

Source: MarketVector IndexesTM. Data as of April 11, 2023.

This topic is explored in some more detail in a whitepaper published in our MVIS Insights of “Introducing The MarketVectorTM Global Defense Industry Index”.

For more information on our family of indexes, visit www.marketvector.com.

Get the latest news & insights from MarketVector

Get the newsletterRelated: