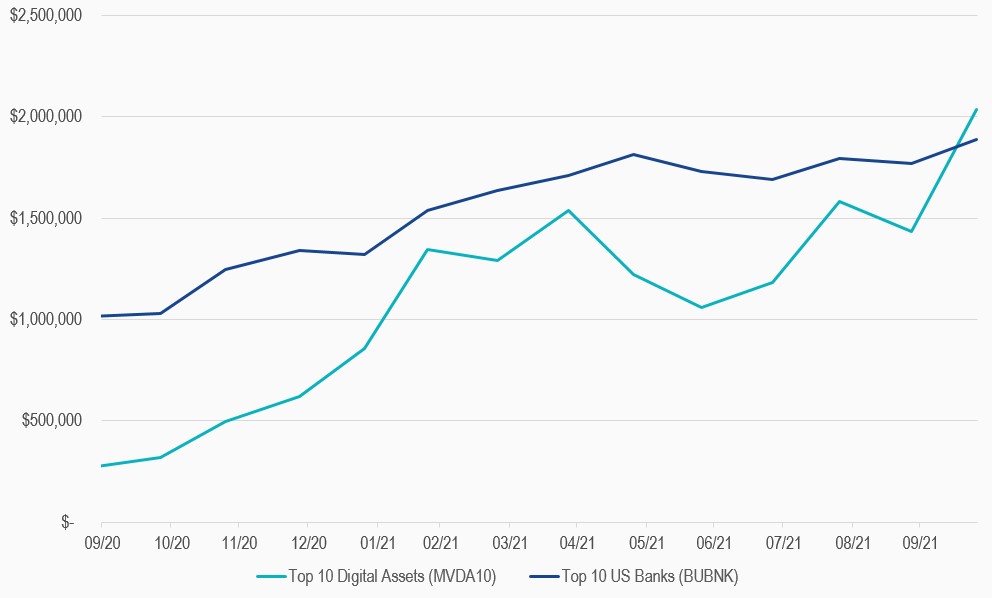

Digital assets, and the technology and software underpinning the asset class, are disrupting traditional financial services, providing alternative channels for capital allocation, and creating new market opportunities and efficiencies. What is clear is that this is not just a technology disruption, but also a social shift driving the rise and acceptance of digital assets. This intergenerational wealth transfer is on the rise – the top digital assets have now surpassed the top US banks in size by market capitalization (refer to chart below). Matthew Sigel, Head of Digital Assets Research at Van Eck Associates, drives home an important point about this rising phenomenon:

“Perhaps, rapidly changing consumer preferences in the face of sticky government support for failing institutions might explain some of this phenomenon… Bitcoin + Ethereum market cap ($1.66T) vs. that of the top six U.S. banks ($1.41T) helps illustrate. The banks' $1.4T market value derives from the gap between their $12.4T in assets and $11.2T in liabilities, and the market's expectations of the return to be earned on that spread. Bitcoin's $1.2T market value, on the other hand, is derived from no such liability, and requires no such spread to sustain it. Thermodynamic energy, code and silicon suffice.”1

MVIS CryptoCompare Digital Assets 10 Index (ticker: MVDA10) is a modified market cap-weighted index which tracks the performance of the 10 largest and most liquid digital assets. BlueStar Top 10 US Banks Index (ticker: BUBNKNTR) tracks the performance of the 10 largest US exchange-listed companies in the banks industry. Investors can access both indices on the MV Index Solutions website.

Top 10 Digital Assets and UK Bank Market Capitalization ($mn) Growth

1 Source: Sigel, Matthew “Putting Bitcoin Futures in Perspective”, 22 October 2021. (www.vaneck.com/us/en/blogs/)

Get the latest news & insights from MarketVector

Get the newsletterRelated: