With global equity markets potentially heading in to a bear market, and technology stocks already in one, many investors are wondering where to hide while others are wondering where to start putting cash to work. A popular idea related to equity investing in bear markets is that the sectors that lead the way down will also lead the way back up. But the market and economic conditions around this market are not typical and could very well lead to a regime change in equity market leadership.

Equities have generally gone uncontested over the last decade or so with nominal and real interest rates at historically low or negative levels. Even if real rates don’t return to positive territory in the near future, investors can now more seriously consider bringing allocations to fixed income closer to “normal” meaning that the propensity to invest in equities with high valuations will be diminished.

In that light, it might be very difficult for some of the high-flying software-focused investment themes to get back to 2021 valuations in the near future. Thematic investing is often pigeon holed to technology-centric ideas. However, themes that are backed by long-term structural growth but are also diversified in terms of sector exposures can offer some protection on the downside while also offering upside potential when markets eventually find a bottom.

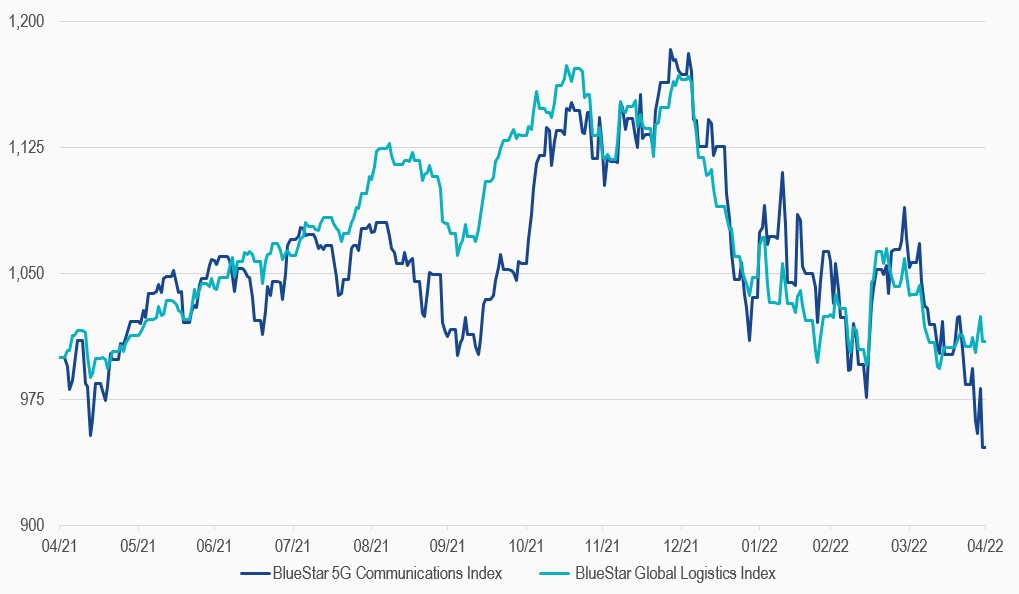

One example would be the BlueStar 5G Communications Index (ticker: BFIVG), which is down 18.5% in 2022 YTD. This marks an outperformance of roughly 4.9% against the Communication Services Select Sector Index and 3.9% against the Russell 1000 Technology Index. This outperformance is despite the fact that BFIVG has high exposure to both the communications services and technology sectors.

BFIVG’s technology exposure is focused on communications equipment/semiconductors (lower P:E ratios that the software industry within technology). Within communications services the index is honed in mostly on telecommunication services (with more utility than technology-like characteristics). Furthermore, BFIVG has a significant exposure to communications-related portions of the real estate market. While all the stocks in the BFIVG index are tied to the long-term theme of wireless communications infrastructure, the index itself is diversified from a sector perspective.

Another example would be the BlueStar Global Logistics Index (ticker: BLOGR) which is down 22.7% in 2022 YTD. This index is designed to offer a derivative exposure to the growth in e-commerce and results in a diversified representation of the global logistics industry including names involved in e-commerce/software, robotics and automation equipment, real estate, and logistics services segments. While the index is under performing the FactSaet Supply Chain Logistics Index by approximately 10%, it is outperforming the EQM Online Retail Index and the ROBO Global Robotics and Automation Index by 19% and 5.52%, respectively.

While some thematic indexes offer highly concentrated exposures to high-flying growth themes, which can work really well in up-markets, broader themes can be designed offer a more diversified and balanced exposure to long-term trends which can work, on a relative basis, in both up and down markets.

BlueStar 5G Communications Index and BlueStar Global Logistics Index

30/04/2021-30/04/2022

Source: MarketVector Indexes. All values are rebased to 100. Data as of 30 April 2022.

About the Author:

Joshua Kaplan is the Global Head of Research and Investment Strategy at MarketVector Indexes. Joshua is involved in MVIS®' index design, maintenance and commercialization activities. He is also responsible for producing research and analysis on MVIS® indexes and investment trends. Josh joined MarketVector Indexes following the acquisition of Indexes in August 2020 where he served as BlueStar's Director of Research and Finance. Prior to joining BlueStar Indexes in late 2011, Joshua specialized in fundamental equity analysis for an Israel-focused hedge fund which was an affiliate of a leading Israeli private equity fund. Joshua is a CFA Charterholder. He holds the FINRA Series 7 Securities License and is a Registered Representative in the States of New York, New Jersey, and Florida. Joshua graduated from Syracuse University with degrees in Finance, Entrepreneurship, and Economics.

The article above is the opinion of the author and does not necessarily reflect the opinion of MarketVector Indexes or its affiliates.