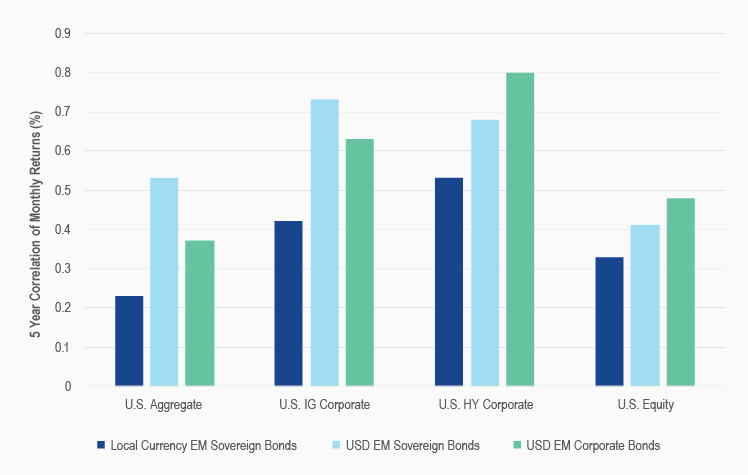

We believe one of the most attractive features of emerging markets debt, from a portfolio construction perspective, is the diversification potential it can provide. Within emerging markets debt, local currency bonds have historically provided the greatest diversification benefit compared to U.S. dollar-denominated emerging markets sovereign or corporate bonds, as measured by the segment’s relatively low correlation to other asset classes.

Source: Morningstar as of 30/9/2019. US Aggregate is represented by the Bloomberg Barclays U.S. Aggregate Bond Index; US IG Corporate is represented by the ICE BofAML US Corporate Index; US HY Corporate is represented by the ICE BofAML US High Yield Index; US Equity is represented by the S&P 500; Local Currency EM Sovereign Bonds is represented by the J.P. Morgan GBI-EM Global Core Index; USD EM Sovereign Bonds is represented by the J.P. Morgan EMBI Global Diversified Index; USD EM Corporate Bonds is represented by the J.P. Morgan CEMBI Broad Diversified Index.

This diversification advantage is driven by the two distinct sources of return that local currency bonds provide: return potential from foreign currency, as well as local interest rates that increasingly tend to be influenced primarily by local conditions rather than developed markets central banks. The fourth quarter of 2018 provides a recent example of how emerging markets debt may help offset weakness experienced in other asset classes. As growth concerns mounted, credit spreads widened significantly and equity markets dropped. With market expectations for further cuts to U.S. interest rates and potentially less support for the U.S. dollar, we believe the return potential of emerging markets local currencies may provide a boost to portfolio returns.

MVEMAG vs. MVEMCL vs. MVEMCD

vs. MVEMSL vs. MVEMSD

Source: MV Index Solutions.

Get the latest news & insights from MarketVector

Get the newsletterRelated: