Introduction: Bitcoin’s Congestion Conundrum

In the frenetic world of digital assets, Bitcoin has led the charge as the flagship of cryptocurrencies. This leading digital currency is currently grappling with increased block space occupancy and escalating transaction fees due to the burgeoning Bitcoin-based Non-Fungible Tokens (NFTs) and token standards like BRC-20. This wave has stirred congestion and apprehensions for everyday transactions.

Among the sea of scaling solutions, the Lightning Network has been making waves. With increasing Bitcoin adoption indicated by the rising Bitcoins volume on Lightning’s state channels, it's a force to be reckoned with. However, sidechains like Stacks and DeFiChain, although experiencing substantial activity, face obstacles in maintaining their growth trajectory.

Bitcoin Ordinals: A New NFT Standard

The Bitcoin ecosystem is witnessing a dramatic surge, courtesy of the Bitcoin Ordinals – a pioneering standard that is said to facilitate the development of Bitcoin-based NFTs. Ordinals employ a clever technique called Inscriptions, where the metadata of NFTs is encoded into a solitary satoshi. The upshot? Over 1.65 million Ordinal inscriptions currently exist, and this figure continues to rise.

BRC-20 Tokens: The Game Changer

BRC-20 tokens, inspired by Ethereum's ERC-20 standard, have further diversified the Bitcoin landscape. More than 14,000 distinct BRC-20 tokens exist, although only a select few have significant trading activity. This expansion has resulted in more and more of Bitcoin's block space being monopolized by BRC-20 or Ordinal transactions, causing Bitcoin user fees to escalate.

Bitcoin Scalability: The Lightning Network to the Rescue?

As Bitcoin's block space demand intensifies, it's clear that a solution is needed for long-term sustainability. This is where the Lightning Network steps in. With over 5,360 Bitcoins circulating in Lightning Network's state channels, the adoption of this notable Bitcoin scaling solution is undeniable. Even as the dollar amount of Lightning's total value locked (TVL) has seen fluctuations, the number of Bitcoin in circulation has steadily increased, indicating an uptick in adoption. However, the high fee environment is hurting the opening and closing of those channels.

Bitcoin Sidechains: Stacks and DeFiChain

While the Lightning Network is making strides, it still struggles with the limitations of Bitcoin's smart contracts. For Bitcoin to evolve further, alternative execution environments are required, and this is precisely what Bitcoin sidechains are vying to provide. Among them, Stacks and DeFiChain have shown promise, albeit with their unique challenges.

Bitcoin Rollups: The Next Frontier?

Bitcoin rollups present yet another scaling solution, although they face significant hurdles due to Bitcoin's smart contract programming language, Script. However, advancements in this area are on the horizon, with players like Rollkit by Celestia and Alpen Labs taking the reins.

Conclusion: The Future of Bitcoin Scaling Solutions

While the journey is far from over, it's clear that Bitcoin's scalability is crucial for it to realize mass adoption. The surge in transaction fees due to Ordinals highlights the need for robust Bitcoin scaling solutions that can support the demands of mass adoption. Regardless of the challenges, the future of Bitcoin scaling seems promising, with numerous potential solutions ready to tackle the hurdles head-on.

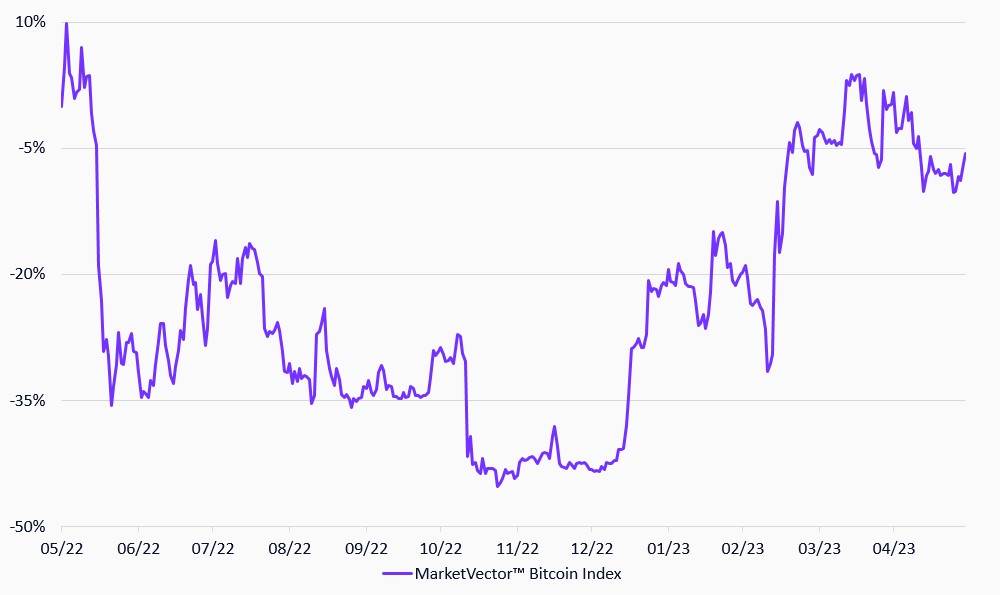

MarketVectorTM Bitcoin Index

29/05/2022-29/5/2023

Source: MarketVector IndexesTM. Data as of May 29, 2023.

Get the latest news & insights from MarketVector

Get the newsletterRelated: