Over the past decade a bellwether for risk appetite has emerged within the fixed income world: emerging markets corporate debt. Here are a few facts you should probably know about this asset class:

- It is approximately twice the size of the emerging markets sovereign external debt universe.

- It is 70% investment grade.

- Dedicated assets under management in the space are a fraction of the assets in either sovereign external or local debt.

- Crossover demand has heightened volatility in the asset class. As more dedicated funds emerge, this effect may continue to diminish.

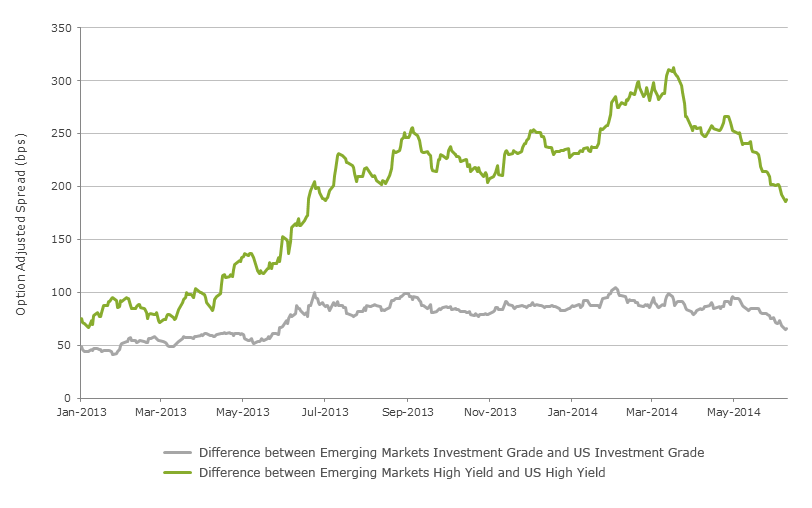

EM corporate debt has recovered about one-half of the underperformance versus US corporate debt it began experiencing when taper talk commenced last year

All data as of 10 June 2014. Source: Merrill Lynch

Get the latest news & insights from MarketVector

Get the newsletterRelated: