European automakers' profitability will be negatively affected by weakening China vehicle demand this year and possibly next. Vehicle pricing in the Chinese market is also deteriorating and remains a concern through 2016. China's move to devalue its currency exacerbates the profit impact of unfavorable pricing.

The current deceleration in new-vehicle demand is a result of softening economic growth as Chinese central planning has overinvested in infrastructure leading to excess capacity, the government crackdown on graft and conspicuous spending by party members, consumers' postponing purchases on expectations that vehicle prices will go down more, and certain caps on annual registrations.

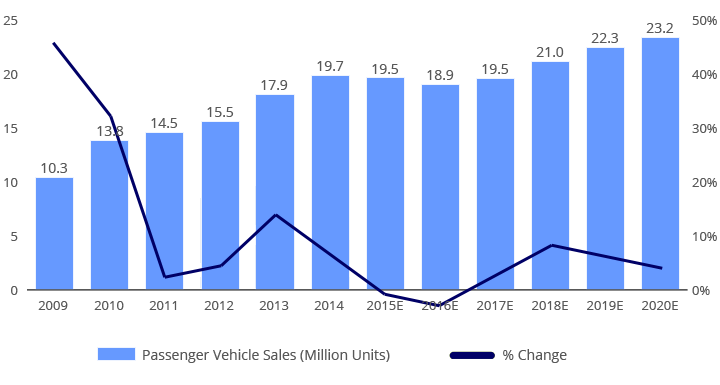

We expect declines in Chinese auto demand in 2015 and 2016, but our thesis remains intact: an annualized long-term demand growth rate in the midsingle digits.

China Passenger Vehicle Sales and Annual Rate of Growth Through 2020

Source: China Association of Automobile Manufacturers; Morningstar

Get the latest news & insights from MarketVector

Get the newsletterRelated: