It appears that the confidence and complacency that has dominated the U.S. stock market for several years is now beginning to dissipate. Investor psychology is changing, the market is no longer bulletproof, and many of the high flying stocks are coming down to earth. Social media is facing a reckoning and unfortunate mishaps for Tesla and Uber suggest autonomous driving may be much more difficult to achieve. Regulators and tax authorities are targeting cryptocurrencies, while hackers target their exchanges.

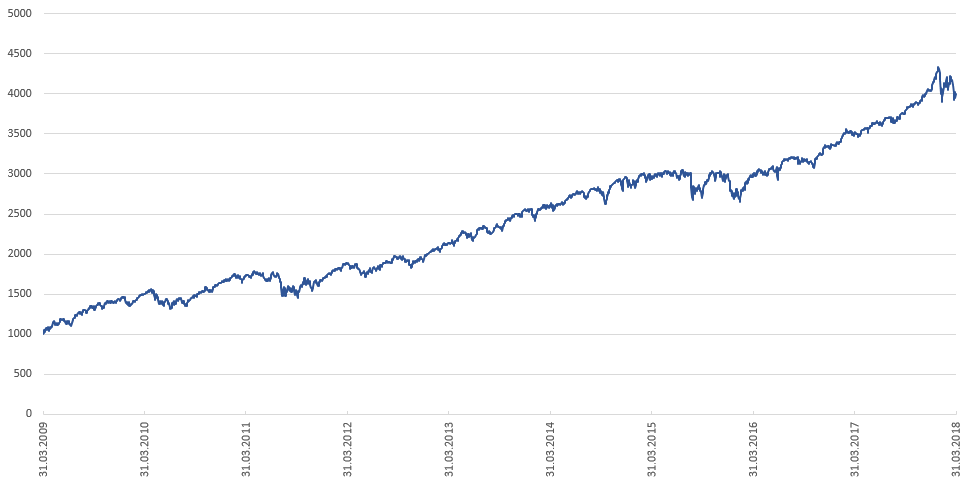

S&P 500: March 31, 2009 – March 31, 2018 on a daily basis

Rebased to 1000 on 31 March 2009

Source: MV Index Solutions

We believe that these, amongst others, are signs that the post-crisis economic and stock market cycle is approaching its end. If we are right, gold and gold stocks stand to benefit if the current market transitions to one filled with risks and volatility. We also believe that once generalist investors take the time to assess gold stocks, they will like what they see — companies with strong balance sheets, cost containment, and good cash flow run by managements incentivized by profitability and shareholder returns.

About the Author:

Joe Foster has been Portfolio Manager for the VanEck International Investors Gold Fund since 1998 and the VanEck – Global Gold UCITS Fund since 2012. Mr. Foster, an acknowledged authority on gold, has over 10 years of dedicated experience in geology and mining including as a gold geologist in Nevada. He has appeared in The Wall Street Journal, Barron's, and on Reuters, CNBC and Bloomberg TV. Mr. Foster has also published articles in a number of mining journals, including Mining Engineering and Geological Society of Nevada.

The article above is an opinion of the author and does not necessarily reflect the opinion of MV Index Solutions or its affiliates.