India's Prime Minister, Narendra Modi, swept to power, not least on the back of a vigorous commitment to re-vitalize the country's economy and re-establish its position as a leader in the emerging markets.

Attracting foreign investment has been a focus for Mr Modi. He has both eased limits on foreign investment in some Indian industries, e.g. defense and railways, and started to address the knotty issue of the country's ubiquitous red tape. Foreign direct investment (FDI) into India last fiscal year rose some 27% compared to the previous year.

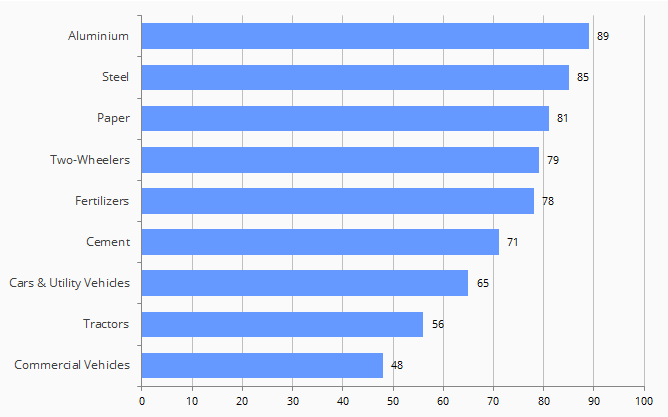

But while FDI figures may be impressive, according to CRISIL (an Indian credit rating agency), for 10 out of 12 of the country's industrial sectors, utilization rates were at 5-year lows.

The potential for growth is obviously there, as is the possibility of uncovering some significant opportunities.Indian Industry Capacity Utilization Rates (%)

Source: Atlas/Quartz – Data CRISIL Research, August 2015

Get the latest news & insights from MarketVector

Get the newsletterRelated: