A recent study by Bank of America Merrill Lynch1 proves it: India has some companies with truly stunning performance. (I use that word stunning judiciously.) And this performance proves the triple themes of: go for growth, buy and hold, and invest for the long term.

Of the 180 stocks remaining from today’s S&P BSE2002 index when cyclical stocks (some 20) are stripped out, 101 have been listed for 20 years or more. A signal figure in itself in a rapidly developing economy.

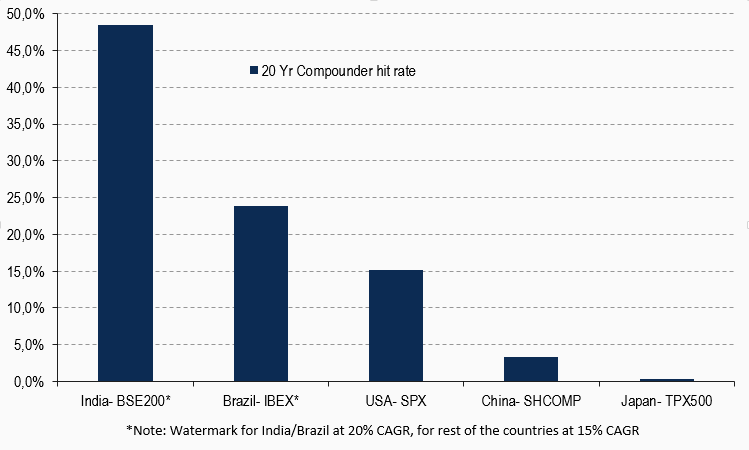

However, it’s the performance amongst these 101 that’s eye-opening: 51 companies (a little over 50%) have, over 20 years, returned a CAGR of at least 20%! And 70% have returned a CAGR of at least 15%.

You only have to compare these figures with similar ones from Brazil, the U.S., China, and Japan, to see there’s really no contest: India wins hands down. And we believe it has only just started.

Proportion of Current Stock Exchange Indices

With 20/15% CAGR Over 20 Years

Source: Bloomberg, Bank of America Merrill Lynch Global Research

About the Author:

Angus Shillington is a Deputy Portfolio Manager at VanEck. Prior to joining VanEck, headed International Equity for ABN AMRO; responsible for Asian and European equity cash and derivative distribution to North American institutions.

The article above is an opinion of the author and does not necessarily reflect the opinion of MV Index Solutions or its affiliates.

Footnotes:

1) Mookim, Sanjay & Kumar, Anand: Transforming India – People Power: The powerful drive of a slowing population, Bank of America Merrill Lynch, April 17, 2017

2) The S&P BSE 200 index is designed to measure the performance of the tip 200 companies listed at BSE Ltd. (Bombay Stock Exchange), based on size and liquidity across sectors.