Inflation expectations remain well above the average of the past almost two decades. More persistent and higher inflation would offset the effect of any rise in interest rates, causing real rates to remain low or negative.

The risk of lower real rates, a weaker than expected post-stimulus economic recovery, higher inflation, a weaker dollar, extreme debt levels, the final bursting of asset price bubbles and other unintended consequences of the massive liquidity injected into the financial system are all factors that may support higher gold prices in the longer-term.

It is not hard to imagine an environment where more than one of these risks could come into play, significantly increasing gold’s appeal as a safe haven, inflation hedge and portfolio diversifier.

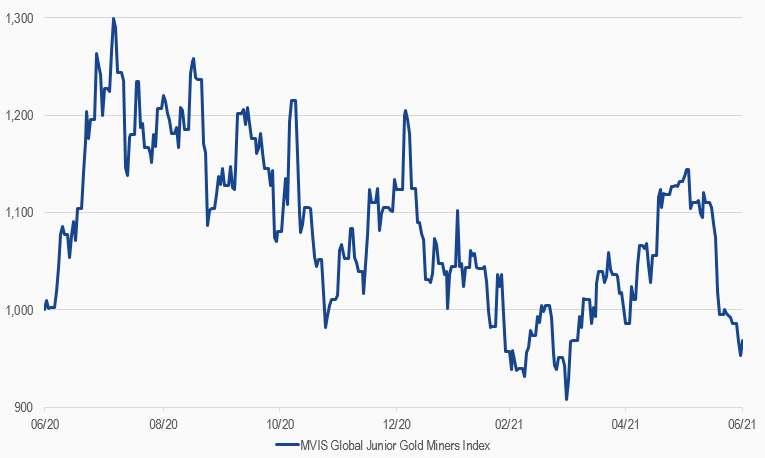

MVIS Global Junior Gold Miners Index

30/06/2020-30/06/2021

Source: MV Index Solutions. All values are rebased to 1,000. Data as of 30 June 2021.

Get the latest news & insights from MarketVector

Get the newsletterRelated: