March 2014

by Imaru Casanova, Senior Gold Analyst, VanEck

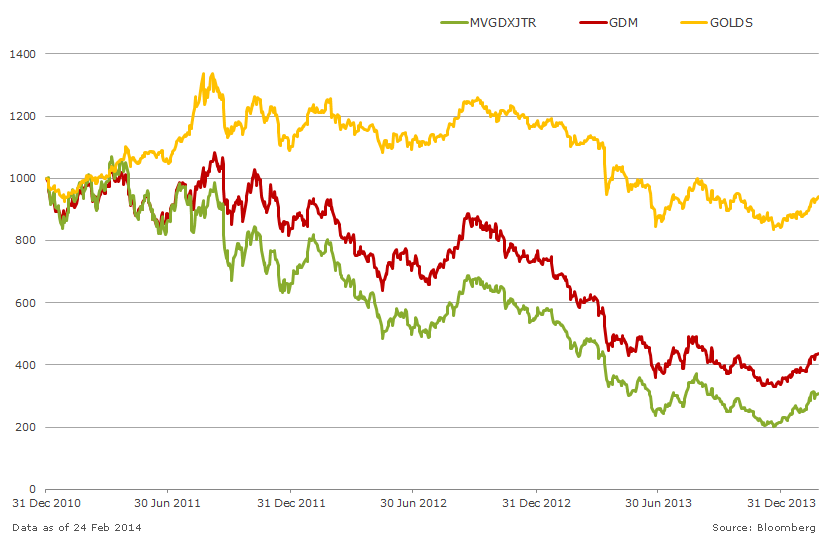

Since the end of 2010, junior gold mining stocks have fallen 69.08%. Large and mid-tier companies have fared a little better than the juniors – down 56.49%. The share price performance differential between the larger and the smaller companies creates the opportunity for sector consolidation. Larger companies struggling to deliver much needed growth can now buy it by acquiring junior peers with depressed valuations. In 2014, too, a number of junior developers will need to finance projects. Do they take on some form of debt, become dormant until conditions improve, or sell out? M&A activity may soon heat up.

- Market Vectors Junior Gold Miners (MVGDXJTR): -69.08%

- NYSE Arca Gold Miners Index (GDM): -56.49%

- GOLD Spot (GOLDS): -5.90%

(Data as of 24 February 2014)

About the Author:

Imaru Casanova holds an appointment as senior gold analyst at VanEck. Mrs. Casanova is a proven expert on gold and gold mining and has been quoted, inter alia, in Barron's, USA Today, Investor's Business Daily and has appeared on CNBC.

The article above is an opinion of the author and does not necessarily reflect the opinion of MV Index Solutions or its affiliates.