Ever since Neil Armstrong became the first man to walk on the moon in 1969, nothing has captured the imagination of mankind more than the exploration of the galaxies and the search for life beyond earth. With its seemingly limitless possibilities, Space — the world beyond our globe — has been a fixture on the hearts and minds of innovators and entrepreneurs.

However, while the space industry news cycle has been dominated by the space race between Jeff Bezos and Elon Musk, and their respective space exploration companies, Blue Origin and SpaceX, it’s been the communications and satellite companies that have been leading the industry. With communication devices becoming the central point of all interactions around the globe, especially during the Covid-19 pandemic when travel has been limited, these companies — along with satellite and satellite equipment companies — and have become essential for everything, from social activities to business meetings, and everything in-between.

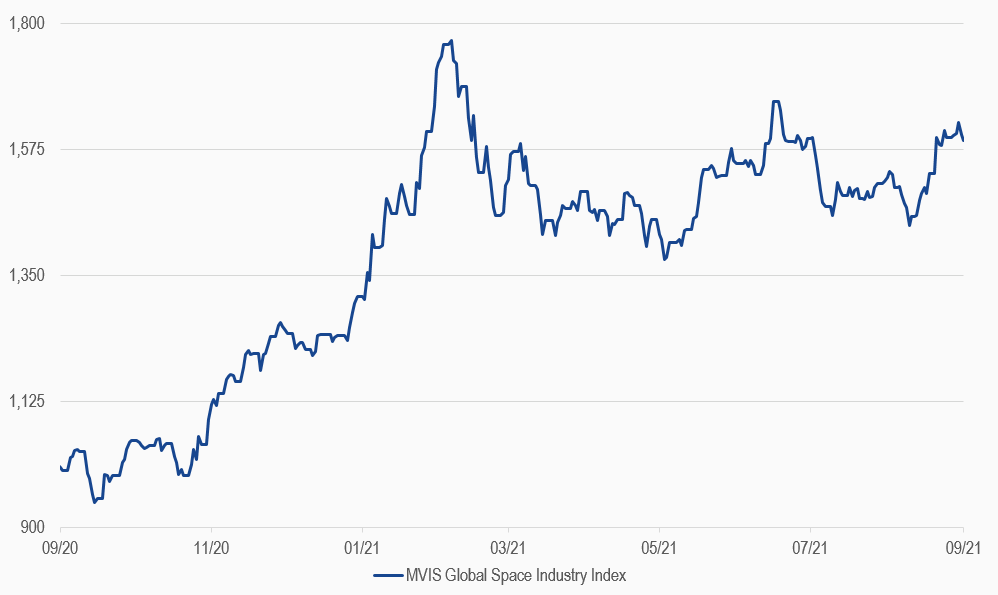

This trend can be seen clearly in the recently launched MVIS Global Space Industry Index (ticker: MVSPC), which tracks the largest and most liquid companies that generate at least 50% of their revenue from Space Exploration, Rockets and Propulsion Systems, Satellite Equipment and Communications Solutions, and Other Satellite Equipment. Though exploration companies have created the biggest news in the space industry, it has been the communications, satellite, and satellite-related equipment companies that have contributed the most towards MVSPC being up nearly 28% YTD and 58% over the last year (as of 10 September 2021).

MVIS Global Space Industry Index

10/09/2020-10/09/2021

Source: MV Index Solutions. All values are rebased to 1000. Data as of 10 September 2021.

Get the latest news & insights from MarketVector

Get the newsletterRelated: