… however, a group of gold companies is especially well equipped to navigate in inflationary periods: the royalty and streaming companies. Along with cash, and bullion, royalty and streaming companies act as defensive investment vehicles in a weak gold price environment. In addition, exposure to this group of companies can also offer protection against cost inflation.

The royalty and streaming companies own a portion of the production or revenues of mines operated by other companies—the operators. These interests are acquired either from a private party (old, historical royalties) or directly from the operators (new streams and royalties). The proceeds from the sale of new streams and royalties are used by the operators as a source of capital, for the development of their mining assets, to fund mergers and acquisitions or to provide additional liquidity.

The royalty and streaming companies represent a key player within the financing options of most mining companies. The agreements are generally structured so that the royalty and streaming companies do not have to contribute to the capital or operating costs of the operation. This protects them from inflationary or any other type of cost increases, while at the same time allows them to benefit from life of mine extensions as a result of reserve growth fully funded by the operators.

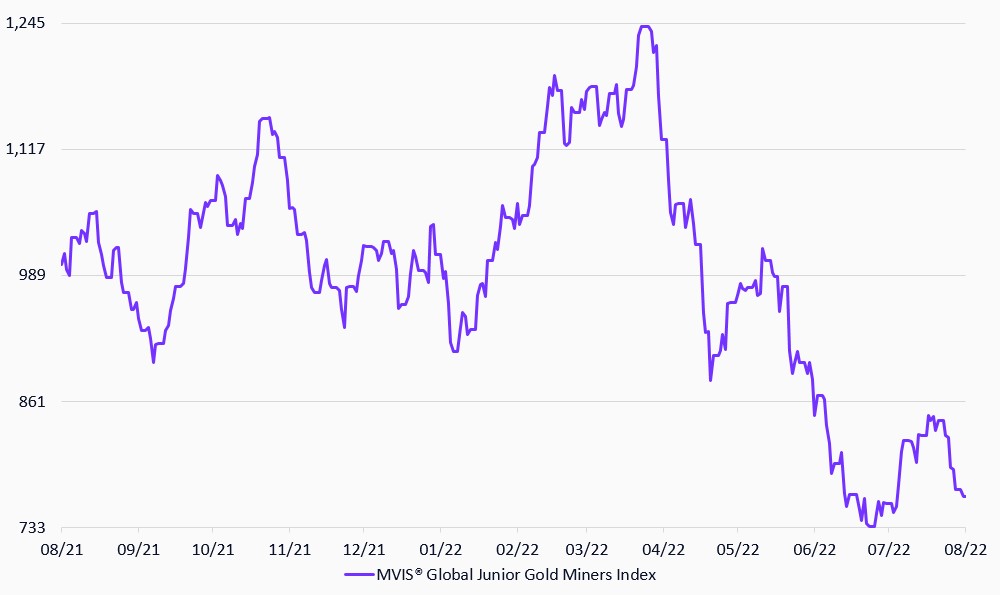

MVIS® Global Junior Gold Miners Index

8/23/2021-8/23/2022

Source: MarketVector Indexes. All values are rebased to 1,000. Data as of August 23, 2022.

Get the latest news & insights from MarketVector

Get the newsletterRelated: