The low prices of oil and gas over the last several years have had a number of far-reaching effects in the energy space. Not least has been the effect on capital expenditure. Conventional oil and gas producers in particular have slashed spending.

Currently, around a third of the world’s current oil supply comes from mature oil fields which are reeling from these cuts and low oil prices. Conventional oil discoveries, too, have plummeted.

But, in face of continuing keen competition from U.S. shale producers, conventional oil and gas producers are, once again, starting to approve projects, most notably projects that can produce cheaply and fast. It will be interesting to see for how long this lasts.

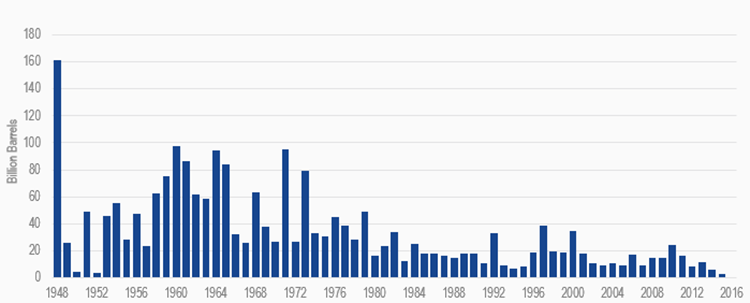

Conventional Oil Discoveries Since 1947*

Source: Wood Mackenzie; Bloomberg. Data as of December 31, 2016.

* Data excludes onshore Canada, U.S. lower-48 onshore, and U.S. shallow water.

Note: 2016 Figure covers exploration results to August. Discoveries amount to just 230 million barrels in 1947 but ballooned the following year with the Ghawar find in Saudi Arabia, still the world's biggest field.

Footnote:

1) The Financial Times: ‘Big Oil’ fights back, July 26, 2017

About the Author:

Tom Butcher is an Associate Director at VanEck. Formerly an independent writer, researcher, and consultant focusing, amongst other things, on strategic materials, in particular metals, Mr Butcher has 38 years of experience in finance. He has lectured and spoken at conferences around the world. Amongst other things, he writes the “Letter from North America” in the Minor Metals Trade Association's publication The Crucible, and was lead author of the chapter on gallium in the British Geological Survey's “Critical Metals Handbook”.

The article above is an opinion of the author and does not necessarily reflect the opinion of MV Index Solutions or its affiliates.