Detecting patterns is an ability we develop early in infancy and refine by experience throughout human life. Categorization is an important part of how humans learn and make optimized decisions when faced with multiple data points. In the crypto world, with over 10,000+ coins, there is an increasing need for a rigorous classification system to structure investment decisions.

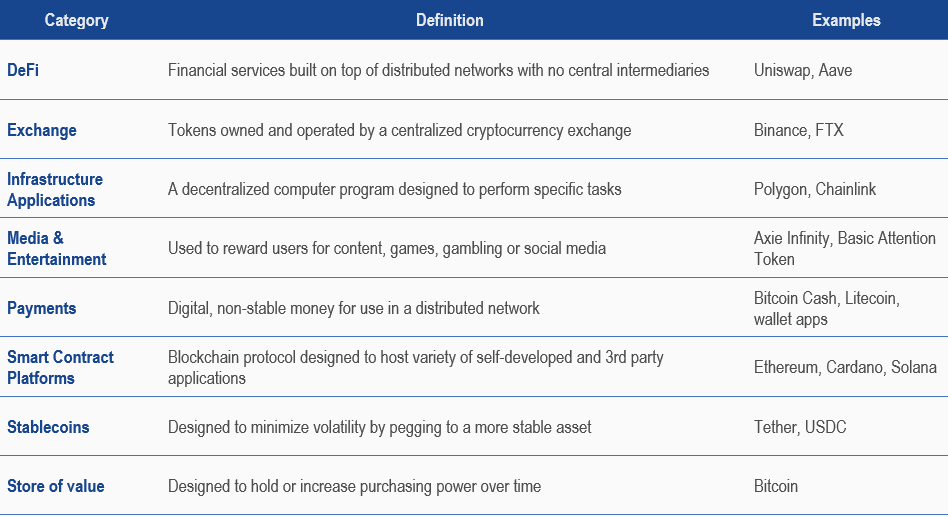

MVIS introduces a categorization of digital asset coins into distinct, non-overlapping categories that form the building blocks for a new crypto classification scheme. Categories capture the value and use case related to a coin. Using a qualitative process, each coin is categorized into one category. Coins may change categories over time and new categories may emerge. The MVIS “Leaders” investable category indices capture the largest and most liquid coins within a category which are also supported by major US crypto exchanges & custodians.

Categories allow investors to group similar digital assets into groups to analyze and proxy targeted exposures. They enable deeper analysis into peers and aggregated performance review, As the basis for investable indices, they provide the underlying components to build an investment solution aimed at capturing the performance of the coins within the category. They allow users to measure, benchmark and capture the performance and characteristics of targeted categories. MVIS categories will help make digital assets digestible to traditional finance investors while giving crypto native funds additional benchmarking capabilities.

MVIS Digital Asset Categories

Source: MV Index Solutions. Data as at 12 October 2021.

Get the latest news & insights from MarketVector

Get the newsletterRelated: