Emerging technologies in the medical devices industry are upheaving traditional tools for patient care, and bionics are among the foremost innovators within this growing industry. The MVIS® Global Bionic Healthcare ESG Index (ticker: MVBION) offers an investable benchmark that tracks companies involved in the operation or implementation of bio-sensors, dental or vision-related implants, prosthesis, bioprinting, or the preservation of organs and tissues, among other medical capabilities.

Factors such as the growing geriatric population and the need to reduce our dependency on human donors are driving the substantial growth observed in the past decade. In the U.S. alone, there are over 100,000 candidates on waiting lists for organ transplants. Related technology in the Bionic Healthcare sector enables methods not only to store and transfer, but implant and engineer organs used to save patients’ lives. Modern healthcare tools capable of bioprinting artificial organs that interact with live tissue have undeniably transformed the healthcare opportunities for patients with medical conditions that were previously thought to be uncurable.

This topic is explored in some more detail in a whitepaper published in our MVIS Insights of “Introducing The MVIS® Global Bionic Healthcare ESG Index”.

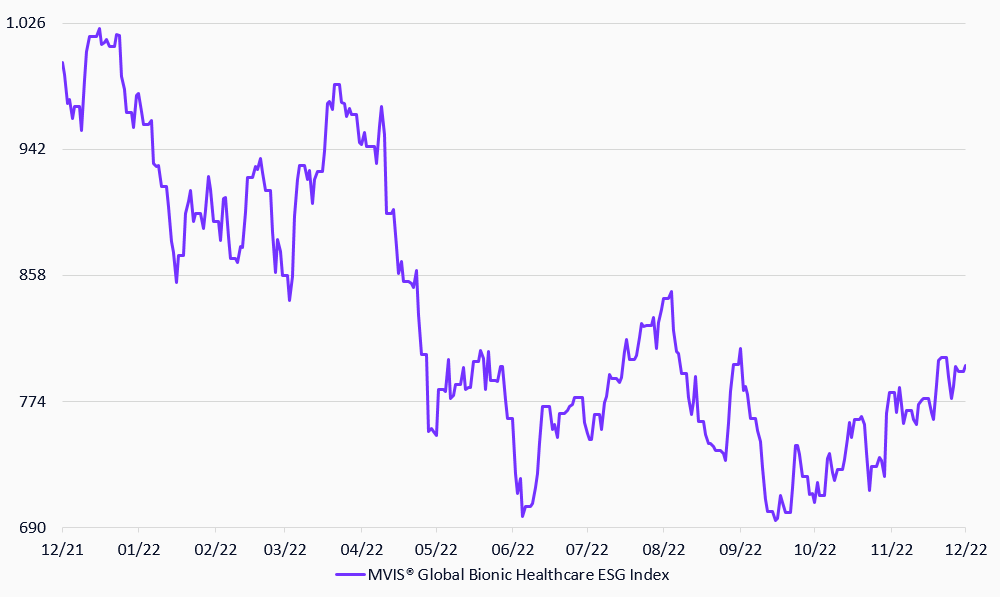

MVIS® Global Bionic Healthcare ESG Index

12/12/2021-12/12/2022

Source: MarketVector IndexesTM. Data as of December 12, 2022.

For more information on our family of indexes, visit us.

Get the latest news & insights from MarketVector

Get the newsletterRelated: