The media and entertainment industry is facing various challenges in the current digital age, including lack of transparency in revenue split, high fees for content creators, and difficulty in adapting to the rapidly changing landscape. However, blockchain technology presents a new solution to these problems, providing the industry with opportunities to create, distribute, and monetize content in new and innovative ways. By using non-fungible tokens (NFTs) and decentralized platforms, the industry can establish more equitable economic conditions for creators and foster a direct connection between creators and their audience.

In a recent whitepaper, the potential of blockchain technology in the media and entertainment industry was explored, with a focus on the current challenges facing the industry. From the decline in album sales and revenue for musicians to the highly centralized nature of film distribution and exhibition, the industry is grappling with various issues.

Blockchain technology offers several advantages to the media and entertainment sector, including the ability to establish more equitable economic conditions for creators and the opportunity to appropriately compensate producers. The use of NFTs, for example, allows musicians to directly monetize their fanbase by tokenizing their music and merchandise. Furthermore, the open metaverse provides a highly scaled, interoperable network of real-time, rendered 3D virtual worlds that have the potential to revolutionize industries such as advertising, gaming, conferences, payments, and the internet itself.

While the industry is still in its early stages, with issues such as lack of clear product-market fit and valuation being key challenges, the potential of blockchain technology in the media and entertainment space cannot be ignored. MarketVector IndexesTM (‘MarketVector’), for instance, offers a media and entertainment index that covers the whole space, making it easier for investors to identify companies with potential for growth and development in this area. Overall, the adoption of blockchain technology in media and entertainment could usher in a new era of innovation and growth in the sector.

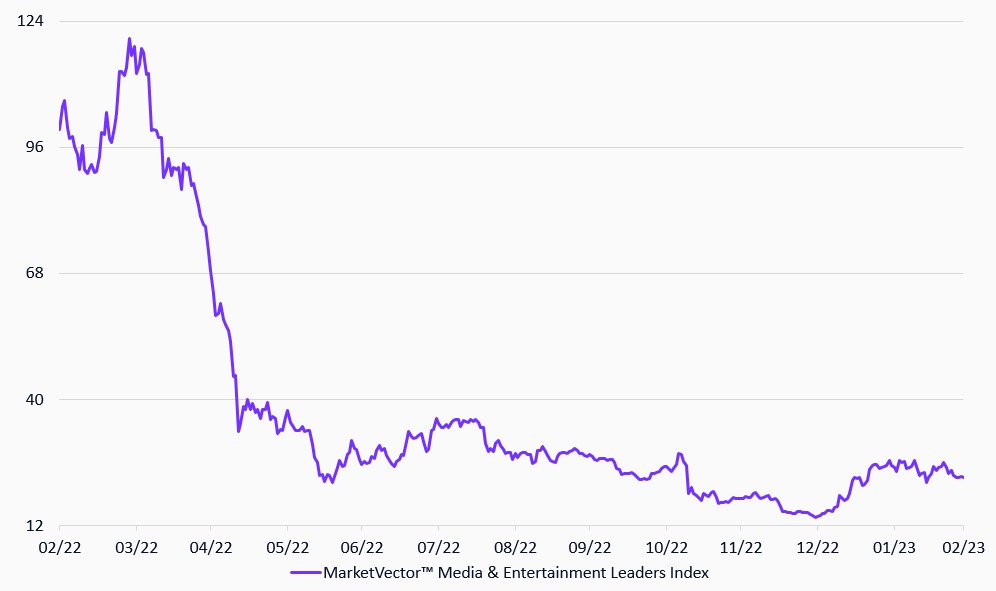

MarketVectorTM Media & Entertainment Leaders Index

28/2/2022-28/2/2023

Source: MarketVector. Data as of February 28, 2023.

This topic is explored in some more detail in a whitepaper published in our MVIS Insights of “The Metaverse and Beyond.pdf”.

About the Author:

Martin Leinweber works as a Digital Asset Product Strategist at MarketVector IndexesTM providing thought leadership in an emerging asset class. His role encompasses product development, research and the communication with the client base of MarketVector IndexesTM. Prior to joining MarketVector IndexesTM, he worked as a portfolio manager for equities, fixed income and alternative investments for almost two decades. He was responsible for the management of active funds for institutional investors such as insurance companies, pension funds and sovereign wealth funds at the leading German quantitative asset manager Quoniam. Previously, he held various positions at one of Germany's largest asset managers, MEAG, the asset manager of Munich Re and ERGO. Among other things, he contributed his expertise and international experience to the establishment of a joint venture with the largest Chinese insurance company PICC in Shanghai and Beijing. Martin Leinweber is co-author of “Asset-Allokation mit Kryptoassets. Das Handbuch “(Wiley Finance, 2021). It’s the first handbook about integrating digital assets into traditional portfolios. He has a Master in Economics from the University of Hohenheim and is a CFA Charter holder.

For informational and advertising purposes only. The views and opinions expressed are those of the authors but not necessarily those of MarketVector Indexes GmbH. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. It is not possible to invest directly in an index. Exposure to an asset class represented by an index is available through investable instruments based on that index. MarketVector Indexes GmbH does not sponsor, endorse, sell, promote or manage any investment fund or other investment vehicle that is offered by third parties and that seeks to provide an investment return based on the performance of any index. Inclusion of a security within an index is not a recommendation by MarketVector Indexes GmbH to buy, sell, or hold such security, nor is it considered to be investment advice.