UK farmland performance in recent years has been phenomenal, with ever increasing interest from investors, largely as farmland is seen as a «safe» investment in unsettled economic times.

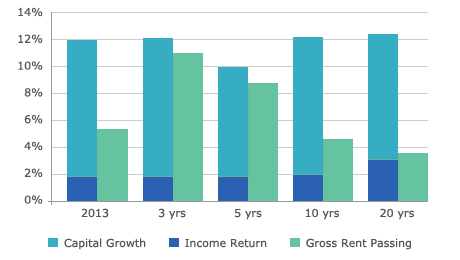

Long term, the main returns have been capital growth and a rise in gross rents. Recently, capital growth has contributed the lion’s share of total returns, leading to murmurs of a price bubble. Future rents are linked to expectations for commodity and food prices.

In the longer term agriculture commodity price increases will come from population growth, climate change and the use of land for bio-fuels. These pressures will sustain income returns and indeed capital growth. Further safety also comes from the limit in farmland supply. To quote the old adage «you can’t make any more of it».

Drivers of Rural Returns (% per annum)

Source: Strutt & Parker Research

About the Author:

Robin Maitland is a Partner of Strutt & Parker LLP. He has 35 years professional experience dealing with all matters relating to rural land, and has spoken at conferences and written many articles on the subject over that period. He is an economics graduate of Exeter University as well as undertaking the Leading Professional Service Firms course at Harvard Business School. He is a Fellow of the Royal Institution of Chartered Surveyors (FRICS)

The article above is an opinion of the author and does not necessarily reflect the opinion of MV Index Solutions or its affiliates.