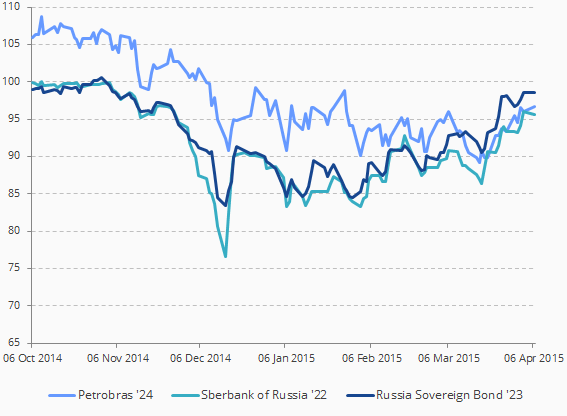

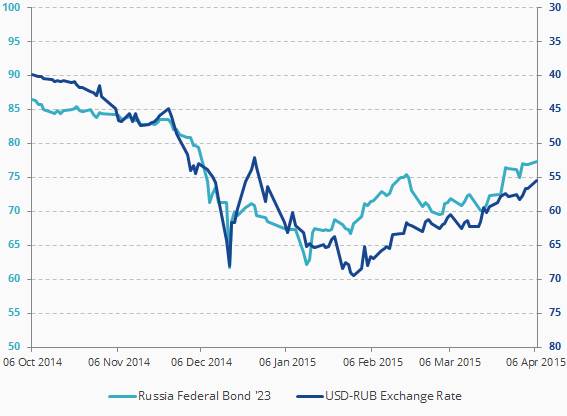

During the first quarter of 2015 more than 115 billion USD of hard currency corporate bonds from Brazil (40 bln USD of Petrobras debt) and Russia were downgraded by one or more ratings agencies to «high yield». 33 billion USD of external sovereign and 43 billion USD local sovereign bonds from Russia met the same fate. Dedicated EM debt investment mandates usually are not ratings constrained; nor is the MVEMAG index. Russia’s hard currency sovereign and corporate bonds have returned over 11% ytd through April 6; its local bonds more than 20%. Petrobras has broken even, but recovered nearly 10% from post-downgrade lows.

Brazil and Russia USD Bonds Recovering Post-Downgrades

Source: Bloomberg

Russia Local Bonds and Ruble Recovering as Well

Source: Bloomberg

Get the latest news & insights from MarketVector

Get the newsletterRelated: