June 2022

Junior stocks normally underperform early in a cycle, but they typically catch up in a month or two and ultimately they outperform their larger peers. There are several possible reasons for the subdued performance in the current bull market:

- Unlike in past secular gold bull markets, the dollar has been strong. This has probably kept the gold price from the spectacular advances seen in the ‘70s’ and ‘2000s’ bull markets. There is not as much market excitement for gold and the juniors so far in this cycle.

- Many commodities are also in a bull market where oil and gas or green metals stocks have taken investors’ attention away from the gold juniors.

- There have been fewer junior acquisitions because the larger producers have not pursued growth as they have in earlier cycles. Producers are also favoring organic opportunities to acquisitions.

- As fewer junior developers are being acquired, more are advancing their properties to production. Unfortunately, there have been too many juniors that have stumbled badly as operators.

Most junior boards and their managements operate under the antiquated mergers and acquisitions (M&A) model of waiting for a larger producer to offer a generous premium that triggers lavish change of control provisions. For them, creating value for shareholders ends at the property line. We believe long-term value creation goes beyond the property line, but there are few (if any) junior managements with the vision and energy to combine companies. This must change.

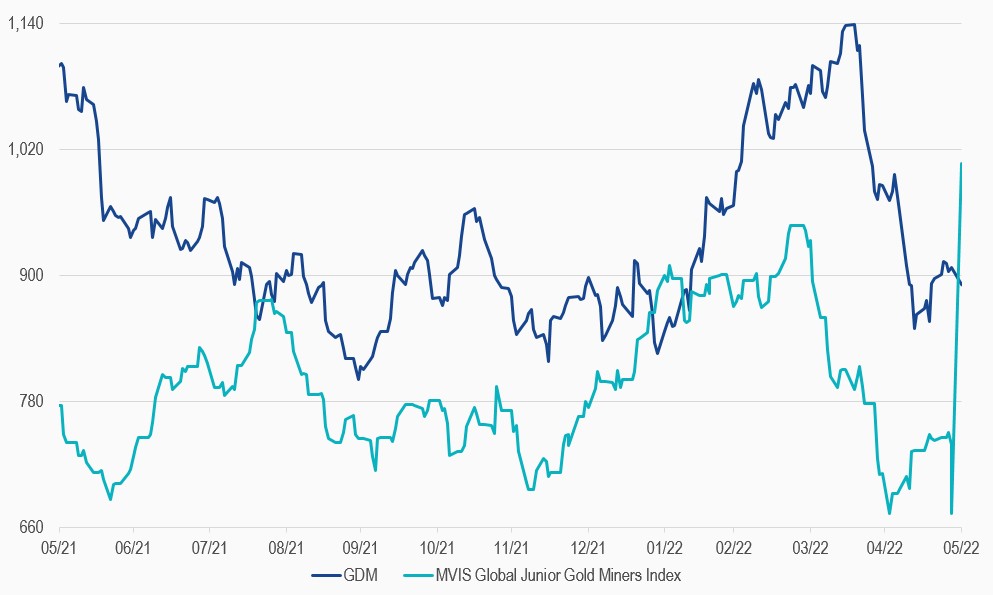

MVIS® Global Junior Gold Miners Index and NYSE Arca Gold Miners Index

31/05/2021-31/05/2022

Source: MarketVector Indexes. All values are rebased to 1,000. Data as of 31 May 2022.

About the Author:

Joe Foster has been Portfolio Manager for the VanEck International Investors Gold Fund since 1998 and the VanEck – Global Gold UCITS Fund since 2012. Mr. Foster, an acknowledged authority on gold, has over 10 years of dedicated experience in geology and mining including as a gold geologist in Nevada. He has appeared in The Wall Street Journal, Financial Times, Barron's, and on Reuters, CNBC and Bloomberg TV. Mr. Foster has also published articles in a number of mining journals, including Mining Engineering and Geological Society of Nevada.

The article above is an opinion of the author and does not necessarily reflect the opinion of MarketVector Indexes or its affiliates.