The history of government funding innovation is extensive and has been a driving force behind technological advancements in various sectors. Government funding, particularly in the form of contracts and support from intelligence and defense agencies, can play a pivotal role in fostering innovation. A notable recent example is Palantir Technologies Inc. (PLTR), a company that specializes in big data analytics and is one of the recent rising stars in the AI theme, with remarkable year-to-date performance of over 200% USD. In its early years, PLTR developed its technology through computer scientists and analysts from intelligence agencies, with early investments from the NSA, the FBI, and the CIA.

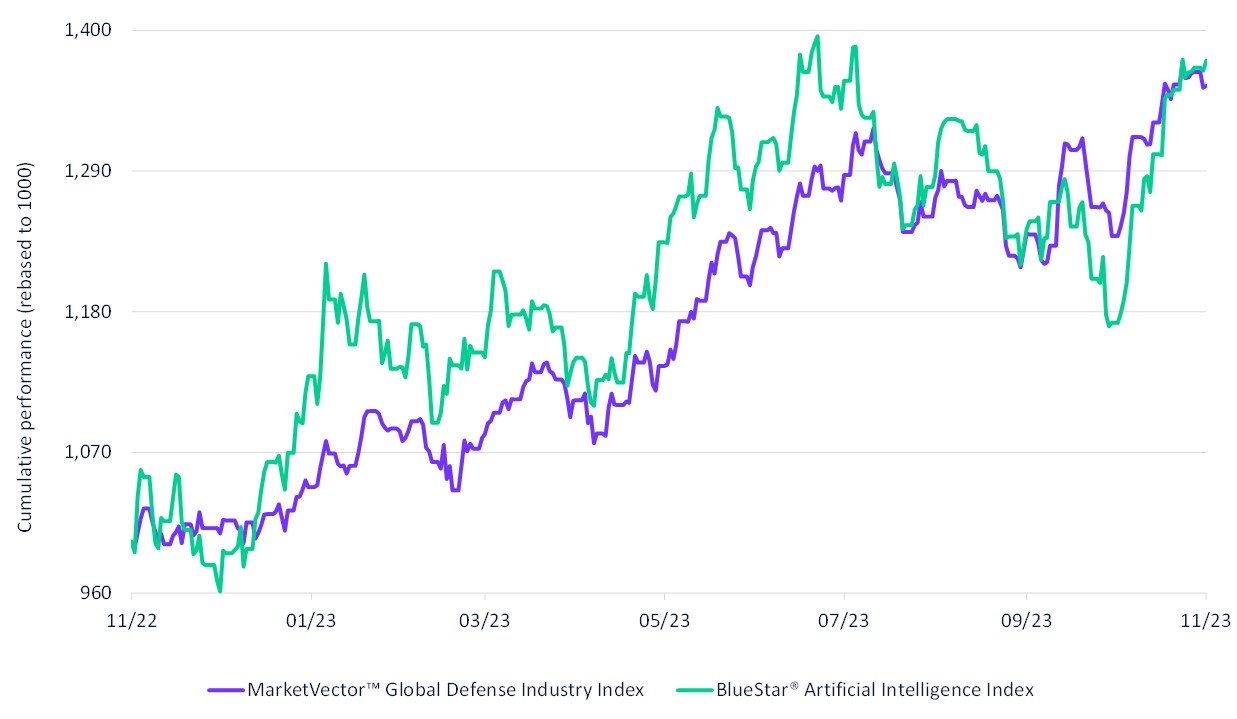

As an AI player with revenue streams tied to the defense industry, PLTR finds itself in both the MarketVectorTM Global Defense Industry Index (MVDEF) and the BlueStar® Artificial Intelligence Index (BAIPR). Despite defensive and AI themes yielding a similar outstanding 38% USD return over the last 12 months, their trajectories to get there differ. MVDEF achieved its gains steadily, with a one-year volatility of 15%, while BAI navigated a more dynamic path with a one-year volatility of 24%.

Index Cumulative Return ending November 28, 2023

Source: MarketVector. Data as of November 28, 2023.

Companies within the defense industry, historically considered defensive investments, have shown resilience during periods of geopolitical turmoil. In navigating the complex interplay of innovation, geopolitical dynamics, and market volatility, a strategic combination of defensive and high-tech stocks can pave the way for a resilient and forward-looking investment approach.

For more information on our family of indexes, visit www.marketvector.com.

Joy Yang is the Head of Product Management and Marketing at MarketVector. She is responsible for managing MarketVector products and services to accelerate innovation in financial index design and adoption. Joy brings more than 25 years of investment experience to MarketVector, having led teams delivering index and quantitative-active investment solutions at Arabesque Asset Management, Dimensional Fund Advisors, Vanguard, Aberdeen Standard Investments, AXA Rosenberg, and Blackrock. She has an MBA from the University of Chicago Booth School of Business and a Bachelor of Science in Electrical Engineering from Cooper Union’s Albert Nerken School of Engineering.

For informational and advertising purposes only. The views and opinions expressed are those of the authors but not necessarily those of MarketVector Indexes GmbH. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts, and other forward-looking statements, that do not reflect actual results. It is not possible to invest directly in an index. Exposure to an asset class represented by an index is available through investable instruments based on that index. MarketVector Indexes GmbH does not sponsor, endorse, sell, promote, or manage any investment fund or other investment vehicle that is offered by third parties and that seeks to provide an investment return based on the performance of any index. The inclusion of a security within an index is not a recommendation by MarketVector Indexes GmbH to buy, sell, or hold such security, nor is it considered to be investment advice.