To kick off with some basic terminology here, in classical computing, a 'bit,' (binary digit), represents the smallest unit of data, capable of holding a single binary value – typically a 0 or 1. On the other hand, a 'qubit,' or quantum bit, is a bit with a unique twist – it can simultaneously represent both 0 and 1, introducing the intriguing concept of superposition.

Who would have thought that such a quantum of difference between the two would ignite a surge of unprecedented opportunities? The ability of qubits to exist in superposition and entanglement, which allows them to be correlated in ways classical bits can't, has opened doors to complex computational paradigms, cryptography methods, and simulations of natural world problems that were once thought to be beyond the reach of classical computers.

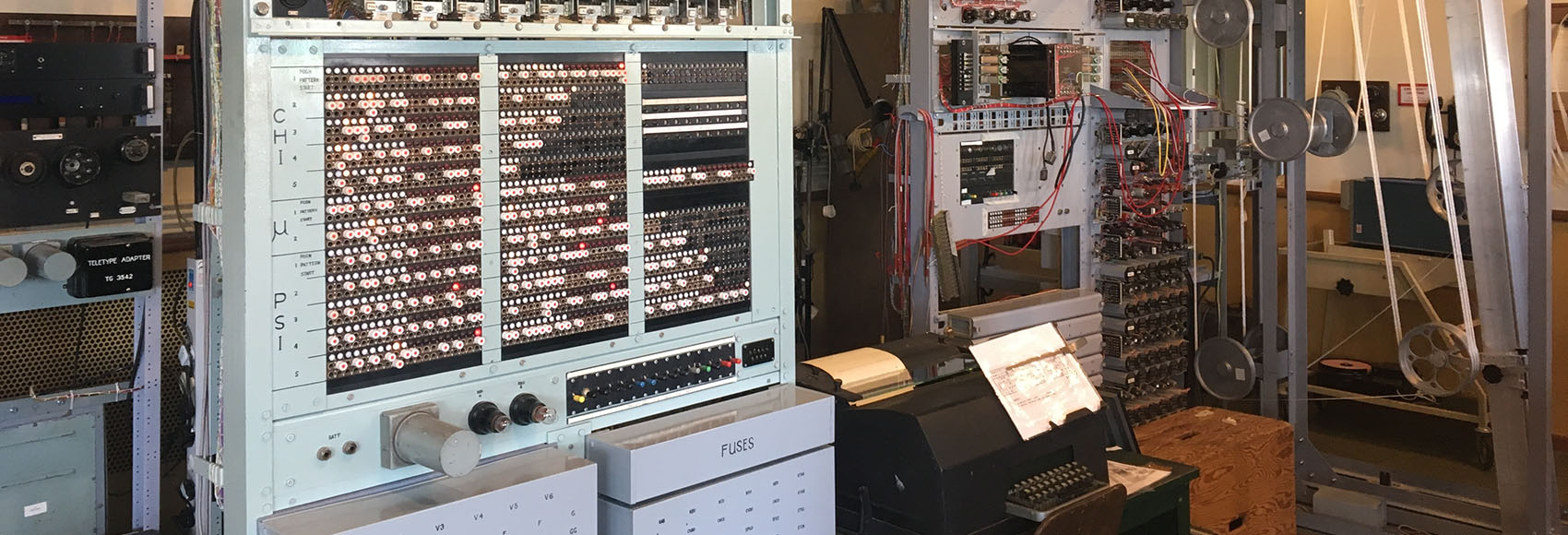

Quantum computing focuses on the development of algorithms and computing solutions, yet its execution necessitates intricate hardware architecture. Presently, there exist significant hardware constraints that limit the widespread commercial utilization of quantum computing. These limitations arise from the considerable physical size, certain temperature prerequisites, and the computational capabilities of existing quantum computers. However, companies like IonQ and IBM have come up with innovative solutions for cloud to host quantum computing algorithms for commercial use.

At this moment, it is clear that quantum computing shows promise in terms of reshaping the technology, revolutionizing computational capabilities, and paving the way for groundbreaking applications across various fields.

BlueStar® US Machine Learning and Quantum Computing Index (BUQFC), which is up almost 26% YTD, and BlueStar® Machine Learning and Quantum Computing Index (BQTUM), up by 35% YoY both provide exposure to quantum computing companies.

BlueStar® Machine Learning and Quantum Computing Index and BlueStar® US Machine Learning and Quantum Computing Index

07/07/2018-11/08/2023

Source: MarketVector. Data as of November 8, 2023.

Kinjal Shukla is the Index Researcher and Data Engineer at MarketVector. She is responsible for the design and development of MarketVector indexes and for creating data infographics. Kinjal has cleared FRM Level 1 having come from a risk profile in Barclays, India. She has a degree in a Master of Science in Financial Engineering from Stevens Institute of Technology, USA, and an MBA-Tech degree from NMIMS-MPSTME University, India.

For informational and advertising purposes only. The views and opinions expressed are those of the authors but not necessarily those of MarketVector Indexes GmbH. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts, and other forward-looking statements, that do not reflect actual results. It is not possible to invest directly in an index. Exposure to an asset class represented by an index is available through investable instruments based on that index. MarketVector Indexes GmbH does not sponsor, endorse, sell, promote, or manage any investment fund or other investment vehicle that is offered by third parties and that seeks to provide an investment return based on the performance of any index. The inclusion of a security within an index is not a recommendation by MarketVector Indexes GmbH to buy, sell, or hold such security, nor is it considered to be investment advice.