Since the Federal Reserve raised the targeted federal funds rate on December 16th last year, a number of changes have occurred in the markets that could presage the demise of one of the longest and deepest bear markets in the history of gold and gold equities.

These changes include:

- Waning conviction in the market regarding further Fed rate increases

- The U.S. dollar’s rise appears to have stalled

- Volatility and weakness in U.S. stock markets

- Strong gold prices despite seasonal weakness in Chinese demand

- Strong gold prices as oil and commodities have sunk to new lows

- Tremendous inflows to gold bullion exchange traded products (ETPs) and gold futures

- Technical breakout from an established downtrend.

Only time will tell.

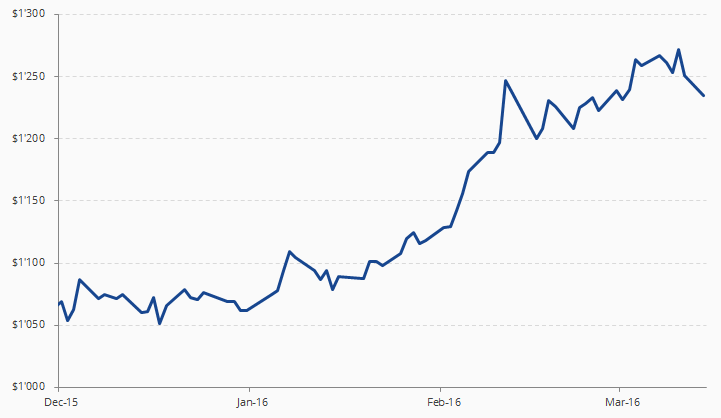

Gold Price per Ounce (USD)

Source: Bloomberg

Joe Foster has been Portfolio Manager for the Van Eck International Investors Gold Fund since 1998 and the Van Eck – Global Gold UCITS Fund since 2012. Mr. Foster, an acknowledged authority on gold, has over 10 years of dedicated experience in geology and mining including as a gold geologist in Nevada. He has appeared in The Wall Street Journal, Barron's, and on Reuters, CNBC and Bloomberg TV. Mr. Foster has also published articles in a number of mining journals, including Mining Engineering and Geological Society of Nevada.

The article above is an opinion of the author and does not necessarily reflect the opinion of MV Index Solutions or its affiliates.

Get the latest news & insights from MarketVector

Get the newsletterRelated: