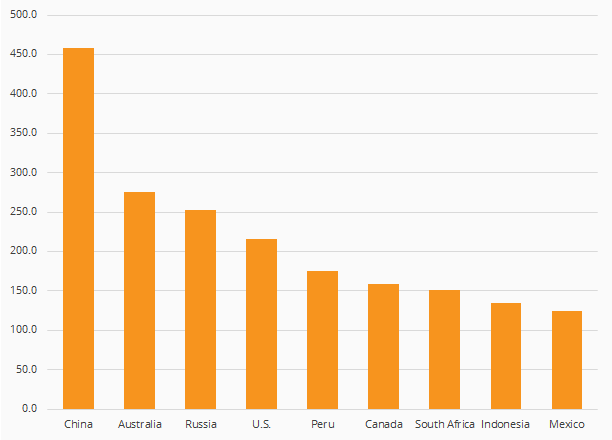

Australia is the second largest gold producer behind China, and ranks ahead of both Russia and the U.S. Recently, there has been a remarkable renaissance in mid-tier and junior producers in Australia.

This has been made possible by: 1) the 28% fall in the Australian dollar (AUD) since 2013 that has reduced costs in U.S. dollar terms; 2) North American companies divesting non-core mines to help pay down debt; and 3) operational improvements and discoveries.

Good management teams at these Australian producers have mitigated the operating risks. We believe currency is now the dominant risk they face.

Top Gold Producing Countries in 2015 (Tonnes)

Source: GFMS Gold Survey 2016 – March 2016

Get the latest news & insights from MarketVector

Get the newsletterRelated: