Business Development Companies (BDCs) can offer high income potential with low interest rate risk.

BDCs lend to and invest in small- to mid-sized private U.S. companies, which tend either to be rated below investment grade or not rated at all. Allocating to BDCs helps investors gain exposure to the growth and income potential of privately held companies, access that has traditionally been limited to institutional or high net worth investors.

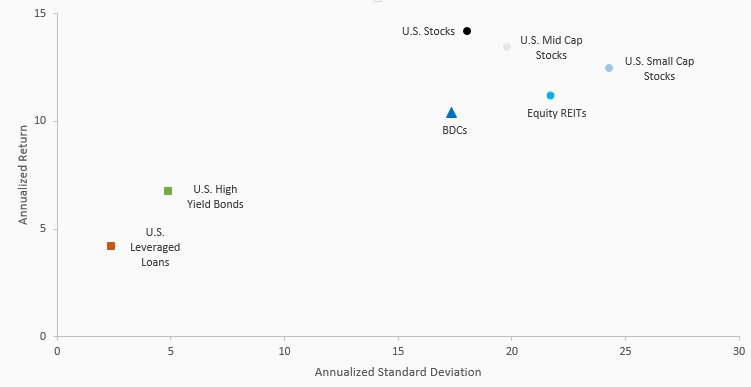

Annualized Standard Deviation versus Annualized Return (%)

8/4/2011 – 3/31/2017

Source: FactSet, Bloomberg. Data as of March 31, 2017.1

Providing access to the private middle market space, BDCs have offered an historically attractive yield component and growth potential. In addition, with more than 70%, on average, of BDCs' loan portfolios structured as floating rate loans, their income is positioned to rise within a rising rate environment.

Footnotes:

Get the latest news & insights from MarketVector

Get the newsletterRelated: