The latest MVIS Digital Asset Insight Paper looks at the correlation and diversification benefits across broad digital asset categories. MV Index Solutions (MVIS) publishes four digital asset category indices:

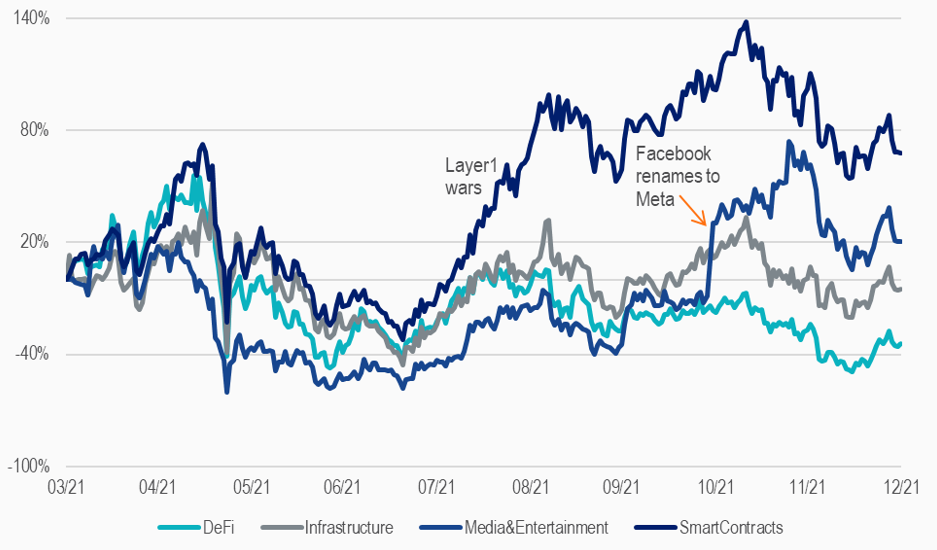

Cumulative returns revealed that the performance of digital asset sectors differ significantly. Phases of high correlation can alternate with phases of high dispersion. Between September and December 2021, the Media & Entertainment category (Decentraland, Axie, Flow etc.) returned 83%, while Decentralized Finance (Uniswap, AAve, Maker etc.) underperformed and returned a disappointing -9%.

Cumulative returns by Classification

31/03/2021-31/12/2021

Thematic classifications can be useful for identifying market cycles and quickly assessing which sectors are outperforming. It enables investors to exploit those narrative plays end enhance the alpha potential of their portfolios. MVIS digital asset thematic category indices allow users to measure, benchmark and capture the performance and characteristics of targeted categories, making digital assets digestible to traditional finance investors while giving crypto native funds additional benchmarking capabilities.

Using well-designed passive indices as the basis for investable digital asset products, investors can target a diversified digital asset investment.

Read more in our Whitepaper