Unpredictability at its finest.

That’s been cryptocurrency’s unofficial motto from the start. It’s the allure which has attracted high-risk investors and the repellent that has kept low-risk investors at bay. And with U.S. regulation still hanging in the balance for the crypto industry, the unpredictability that has defined the digital assets industry isn’t going away anytime soon.

However, for those conservative investors that can’t handle the heart palpitations that come with the wild fluctuations of Bitcoin or Ethereum, or for those novice investors that have difficulties trying to assess which of the other thousands of smaller cryptocurrencies besides Bitcoin one could buy, the digital assets industry may no longer need to be a spectator sport for them — digital asset indexes containing small and mid-cap cryptocurrencies could be the right place to turn. As more and more money pours into cryptocurrencies, the flow of money is moving away from digital assets with higher market capitalization and shifting towards lesser known or lesser capitalized cryptocurrencies, potentially offering the same, or even better, returns. As the market concentration continues to decrease, investors’ digital assets portfolios could profit from higher diversification, potentially allowing them to continue partaking in the crypto boom.

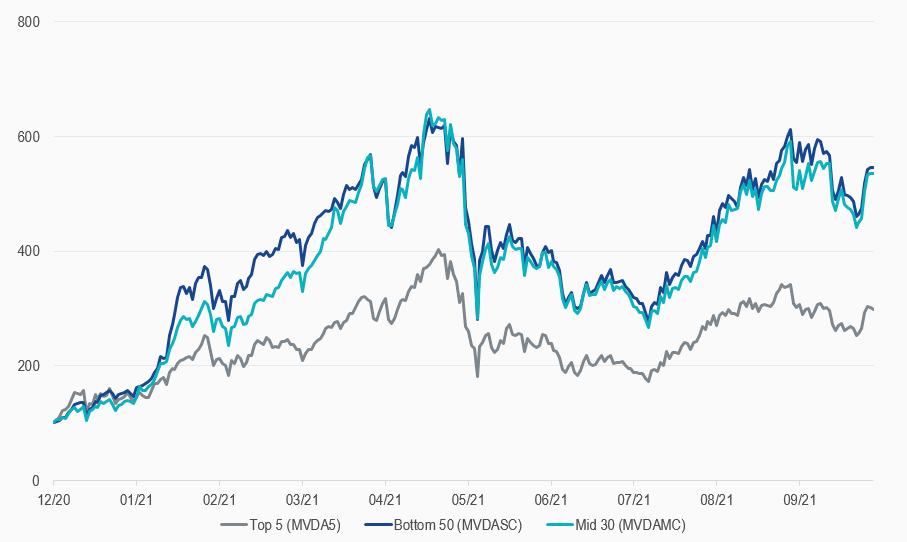

This trend has been reflected in MVIS’s digital asset indexes. The MVIS’s CryptoCompare Digital Assets 100 Small-Cap Index (Ticker:MVDASC), which tracks the performance of the 50 smallest digital assets in the MVIS CryptoCompare Digital Assets 100 Index, is up nearly 445% YTD and the MVIS’s CryptoCompare Digital Assets 100 Mid-Cap Index (Ticker:MVDAMC), which tracks the performance of the 30 mid-size digital assets in the MVIS CryptoCompare Digital Assets 100 Index, is up nearly 435% YTD. Alternatively, the MVIS CryptoCompare Digital Assets 5 Index (Ticker:MVDA5), which tracks the performance of the 5 largest and most liquid digital assets in the MVIS CryptoCompare Digital Assets 100 Index, is up 198% YTD.

MVIS Digital Asset Indices

31/12/2020-04/10/2021

Source: MV Index Solutions. All values are rebased to 100. Data as of 4 October 2021.

Get the latest news & insights from MarketVector

Get the newsletterRelated: