Gold Miners – Q4 2017 Earnings/Financial Results Mixed

March 2018

By Joe Foster, Portfolio Manager and Strategist

The negative sector headlines put significant selling pressure on the stocks. In many cases, these negative surprises have shorter-term effects, and do not change the companies’ fundamental valuations. However, more recently, it appears that selling pressure might be intensified by headline-driven, algorithm-based trading where the longer-term fundamentals are ignored.

In February, many gold companies reported positive operating results for the last quarter of 2017. However, earnings/financial results were mixed and guidance for 2018, in some cases, seems to have surprised the markets.

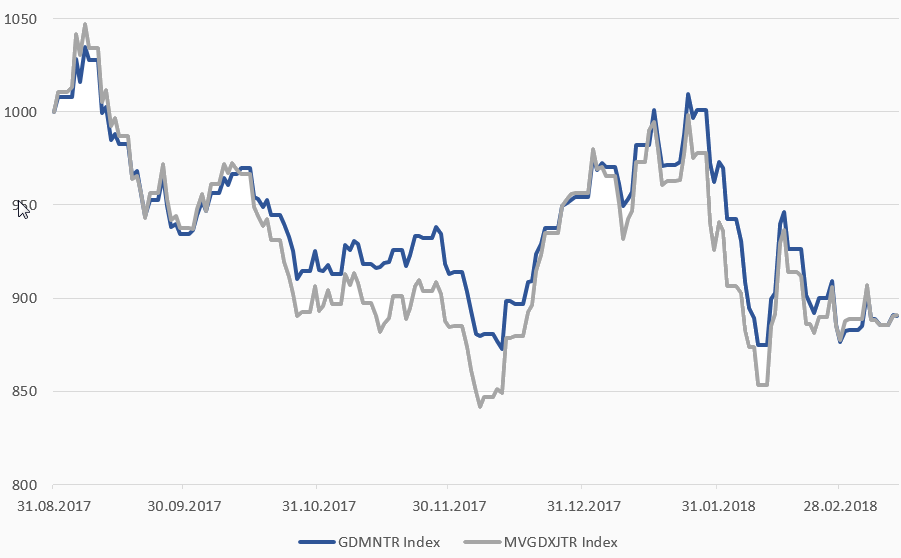

While gold stocks underperformed in February, the junior companies caught up with their larger peers, after underperforming in January.

GDMNTR vs. MVGDXJTR

Source: Bloomberg and VanEck

Get the latest news & insights from MarketVector

Get the newsletterRelated:

About the Author:

Joe Foster has been Portfolio Manager for the VanEck International Investors Gold Fund since 1998 and the VanEck – Global Gold UCITS Fund since 2012. Mr. Foster, an acknowledged authority on gold, has over 10 years of dedicated experience in geology and mining including as a gold geologist in Nevada. He has appeared in The Wall Street Journal, Barron's, and on Reuters, CNBC and Bloomberg TV. Mr. Foster has also published articles in a number of mining journals, including Mining Engineering and Geological Society of Nevada.

The article above is an opinion of the author and does not necessarily reflect the opinion of MV Index Solutions or its affiliates.