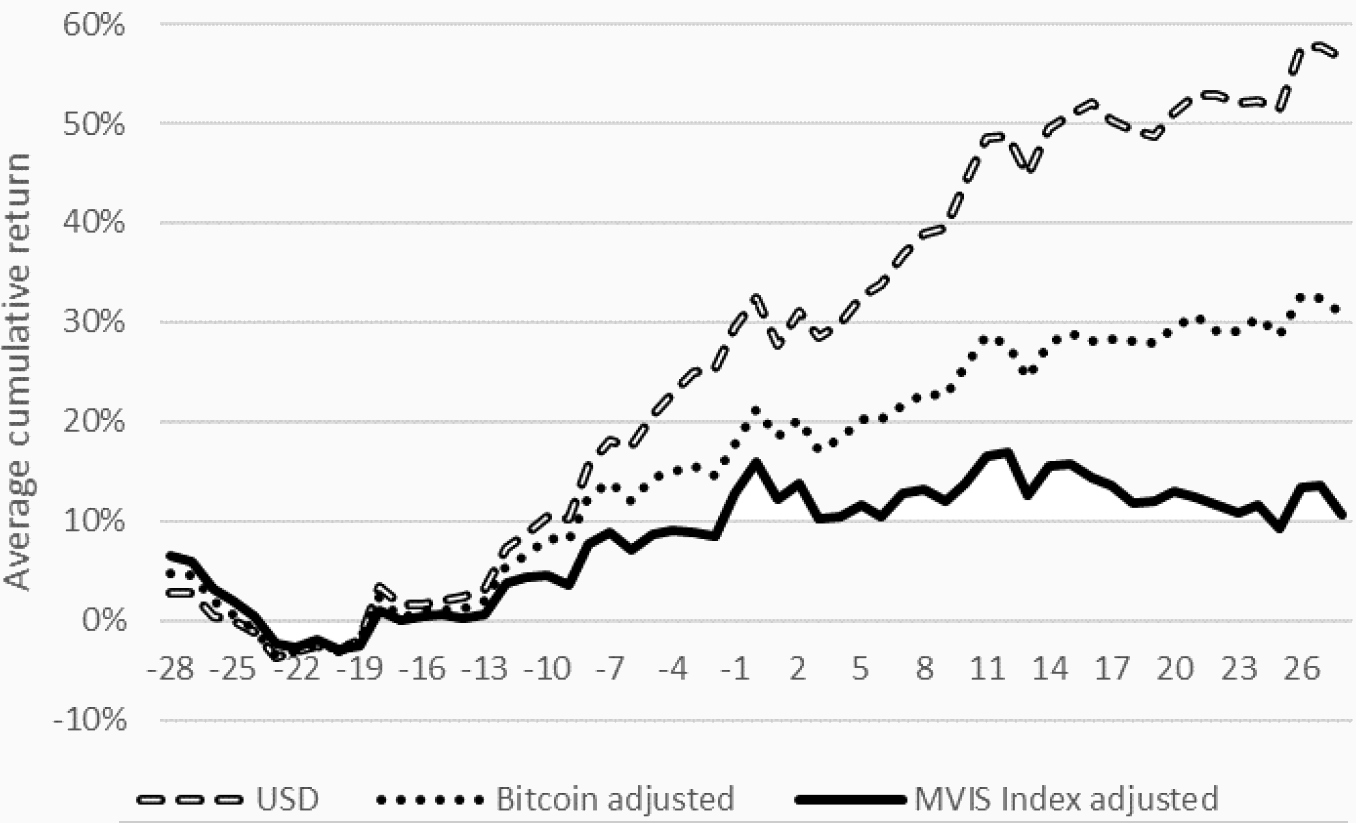

I find significant increases in price and trading activity around the date of a token’s first cross-listing. Tokens observe a 49% raw cumulative return in the two weeks around the cross-listing date. Token trading volume is almost 50 times higher after cross-listing. The price increase is not related to cross-listing to larger volume marketplaces, but to marketplaces that serve different user/investors and have stricter listing and user identification requirements. Most importantly, this finding goes again the common idea of investors taking advantage of the crypto “Wild West”. I find investors prefer and reward tokens listed in more regulated marketplaces.

Raw and adjusted cumulative token returns around the date of first cross-listing

Source: The Economics of Digital Token Cross-Listings, Hugo Benedetti, 25 November 2018.

Read full paper here.

Get the latest news & insights from MarketVector

Get the newsletterRelated: